Optionally Bypass Taxation of State and City Miscellaneous Taxes

Wage Accumulation functionality is available only for Federal, State and Local income taxes. This permits both employee wages and withholding for each of these tax types to be marked as exempt. With this release, you can now configure whether to bypass the calculation of State and City Miscellaneous (MISC) taxes like state-level Paid Family and Medical Leave and Long Term Care contributions. Bypassing calculation of these taxes can also prevent unnecessary employee wage accumulation. This reduces the need for performing balance adjustments to prevent these types of wages from being reported erroneously on the employee W-2 form.

You can now optionally bypass tax calculation and prevent unnecessary accumulation of the following subject-related "Miscellaneous" wages for employees claiming exemption from:

- State MISC1 - Oregon Statewide Transit Tax (STT) and Vermont Child Care Contribution (CCC) Tax

- State MISC2 - State Paid Family and Medical Leave (PFML). Currently this applies to the following states:

- Colorado PFML

- Connecticut PFML – Employee Only

- Delaware PFML - Effective from January 1, 2025

- District of Columbia PFL – Employer Only

- Maine PFML - Effective from January 1, 2025

- Massachusetts PFML

- Oregon PFL

- Washington PFML

- State MISC4 - Washington Long Term Care (WA CARES)

- State SPEC1 - Portland, Oregon Metro Supportive Housing Services (SHS) Tax

- City MISC - Currently this applies to Eugene (Oregon) Community Safety Payroll tax and Seattle (Washington) Payroll Expense tax

Bypassing calculation of these taxes can prevent unnecessary employee wage accumulation. This reduces the need for performing balance adjustments to prevent these types of wages from being reported erroneously on the employee W-2 form.

Steps to Enable

To optionally bypass tax calculation and prevent unnecessary accumulation of subject-related "Miscellaneous" wages at both the state and local level, new fields have been added at both GRE and employee assignment levels.

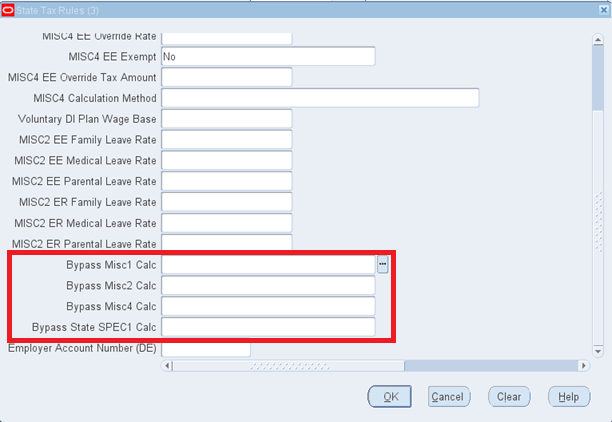

You may configure the following new fields at GRE level in the State Tax Rules (3) descriptive flexfield (DFF) for the applicable state to prevent unwanted miscellaneous type tax calculation and wage accumulation. Using the applicable HRMS Manager responsibility, navigate to Work Structures > Organization > Description > query the applicable organization (GRE) > click in GRE/Legal Entity > Others > State Tax Rules (3) > Select the applicable state and then optionally update the following new fields:

- Use “Bypass Misc1 Calc” for State MISC1 wages (Oregon STT and Vermont CCC tax)

- Use “Bypass Misc2 Calc” for State MISC2 (PFML) tax

- Use “Bypass Misc4 Calc” for State MISC4 (WA Cares) tax

- Use ‘Bypass State SPEC1 Calc” for State SPEC1 (Portland Metro SHS) tax

State Tax Rules (3) DFF at GRE level showing new Bypass fields

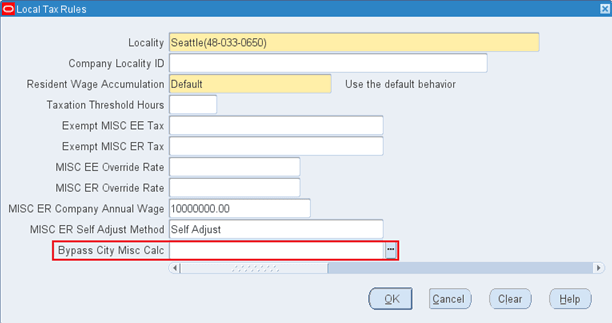

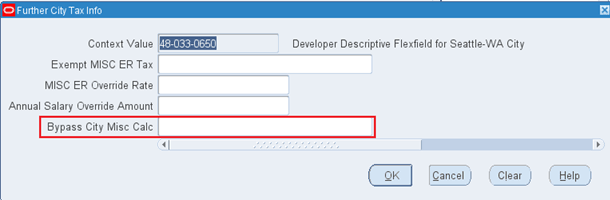

Additionally, you may configure new field Bypass City Misc Calc at GRE level. Using the applicable HRMS Manager responsibility, navigate to Work Structures > Organization > Description > query the applicable organization (GRE) > click in GRE/Legal Entity > Others > Local Tax Rules > Select the applicable locality (currently this is only applicable to Eugene, Oregon and Seattle, Washington).

Local Tax Rules DFF at GRE level showing new Bypass City Misc field

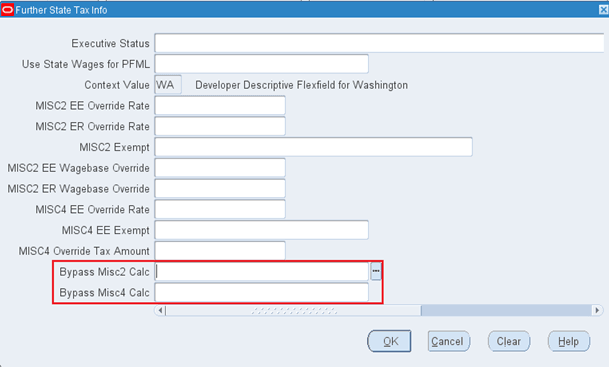

You may also configure the following new fields at employee assignment level to prevent unwanted State miscellaneous wage accumulation by navigating to People > Enter and Maintain > query the applicable employee > Assignment > Tax Info > select the applicable state > Click in the Further State Tax Info DF ellipsis. (Note that the available fields may differ depending on the state selected. In this case, the state of Washington has been selected.)

- Use “Bypass Misc2 Calc” for State MISC2 (PFML) wages

- Use “Bypass Misc4 Calc” for State MISC4 (WA Cares)

Bypass Fields in Employee Assignment > State Tax Info > Further State Tax Info DFF

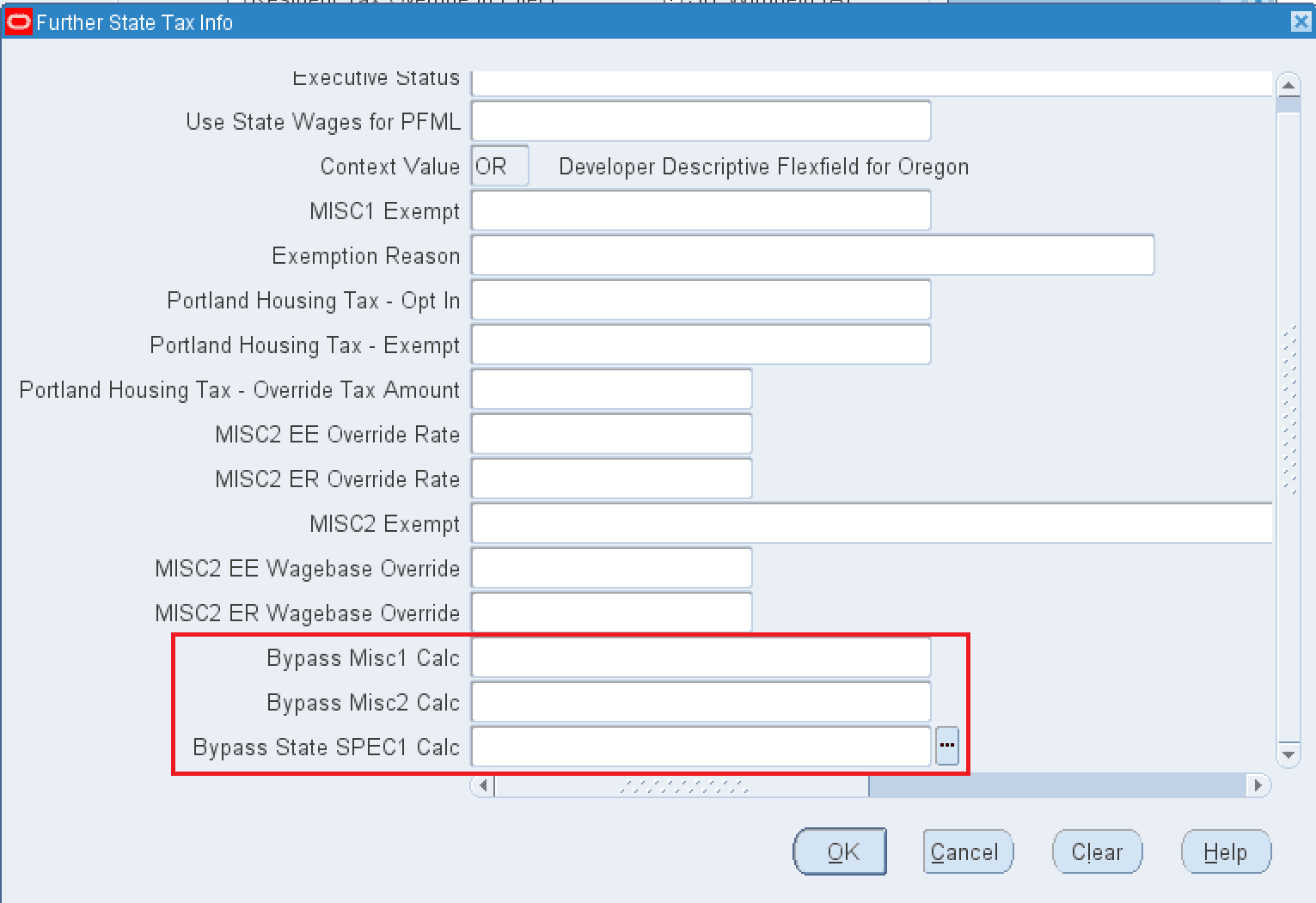

Additional bypass fields are also available at the employee assignment level if the state of Oregon is selected. Navigate to People > Enter and Maintain > query the applicable employee > Assignment > Tax Info > select the applicable state (in this example Oregon) > Click in the Further State Tax Info DF ellipsis.

- Bypass Misc1 Calc for either Oregon Statewide Transit Tax (STT) (or Vermont Child Care Contribution (CCC) tax)

- Bypass Misc2 Calc for State MISC2 (PFML) wages

- Bypass State SPEC1 Calc for Portland Metro Supportive Housing Services (SHS) tax

Bypass fields available in Further State Tax Info DFF at assignment level for the State of Oregon

You may also configure the following new field at employee assignment level to prevent unwanted City miscellaneous wage accumulation by navigating to People > Enter and Maintain > query the applicable employee > Assignment > Tax Info > select the applicable state > select the applicable county > select the applicable city > Click in the Further City Tax Info DF ellipsis:

- Use “Bypass City Misc Calc” field

Bypass City Misc field in Local Tax Rules at Employee Assignment level

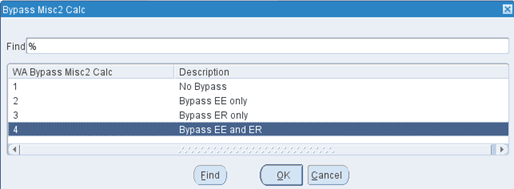

For each the above fields, you may select from the following options. (Note that not all of these options may apply to every Bypass field at either level.)

- No Bypass: This is the default option. The applicable Miscellaneous state or city tax will be processed as normal with no bypass occurring.

- Bypass EE Only: Select this option to only bypass the calculation of the employee component of the applicable miscellaneous tax, and no employee miscellaneous wages for the applicable tax type will accumulate. The employer tax component will still be processed (where applicable), and the employer-level wages will still be accumulated (where applicable).

- Bypass ER Only: Select this option to only bypass the calculation of the employer component of the applicable miscellaneous tax, and no employer miscellaneous wages for the applicable tax type will accumulate. The employee tax component will still be processed (where applicable), and the employee-level wages will still be accumulated (where applicable).

- Bypass EE and ER: Select this option to bypass calculation/processing of BOTH employee and employer miscellaneous tax components. NO miscellaneous wages for the applicable tax type will be accumulated for employee or employer.

Bypass Field Selection Options

Tips And Considerations

Important Note: Configuring any field at the employee assignment level will override any configuration for the same field at GRE level.

Key Resources

- Oracle HRMS Payroll Processing Management Guide (US)

- Topic: Preventing Wage Accumulation for Miscellaneous (MISC) Taxes