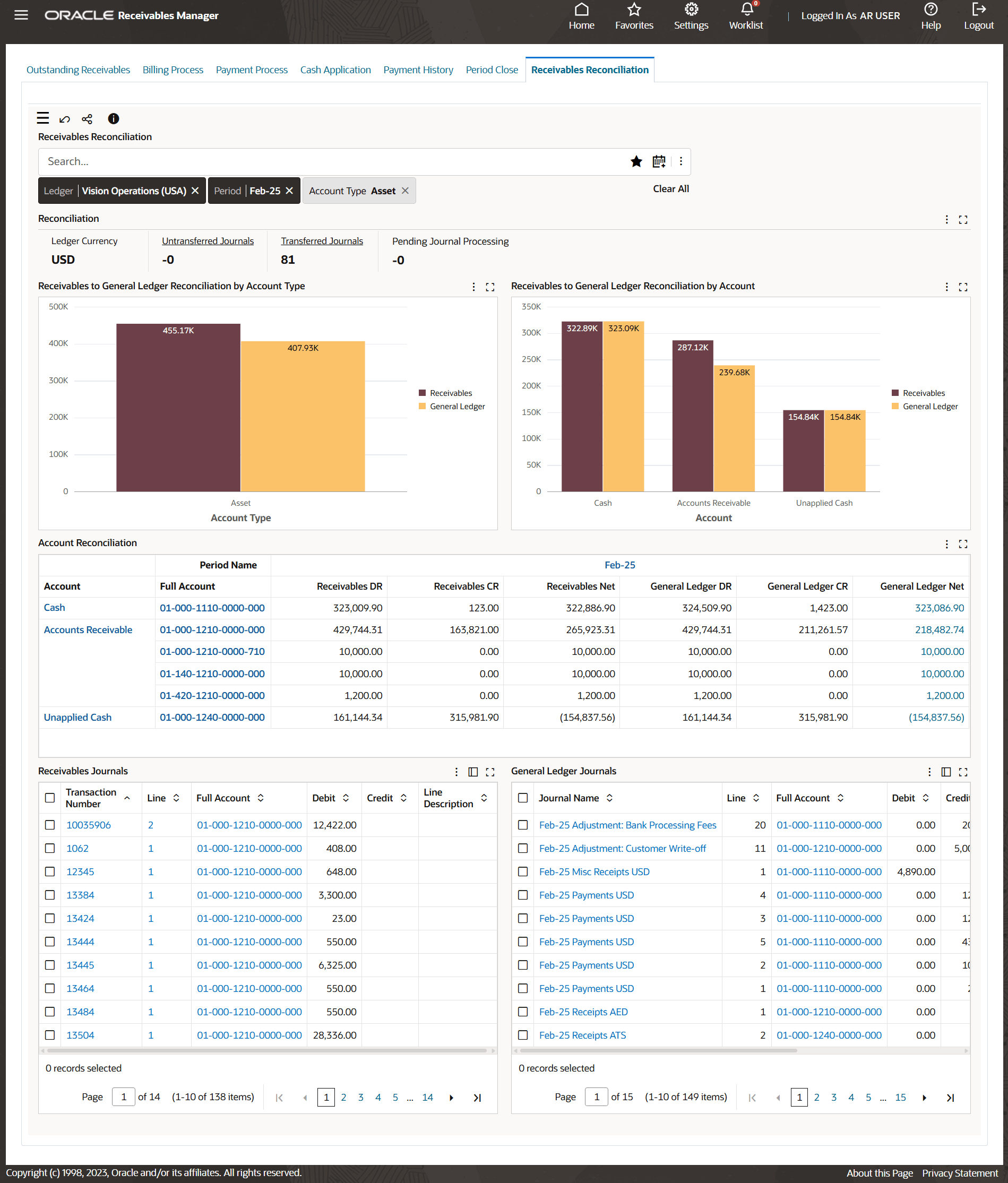

Receivables Reconciliation Dashboard

Receivables teams can now effectively monitor the reconciliation process and its status using the Receivables Reconciliation Dashboard. The Receivables Reconciliation Dashboard has the capability to:

Identify mismatches between the Receivables subledger and General Ledger balances. Drill down from high-level discrepancies to specific transactions, receipts, or adjustments. The dashboard also shows the link between receivable transactions and journal entries, providing a clear audit trail, which enables teams to prepare for audits. Receivables and general ledger teams can also effectively collaborate using the dashboard’s shared view of reconciliation status and exceptions.

Receivables Reconciliation Dashboard

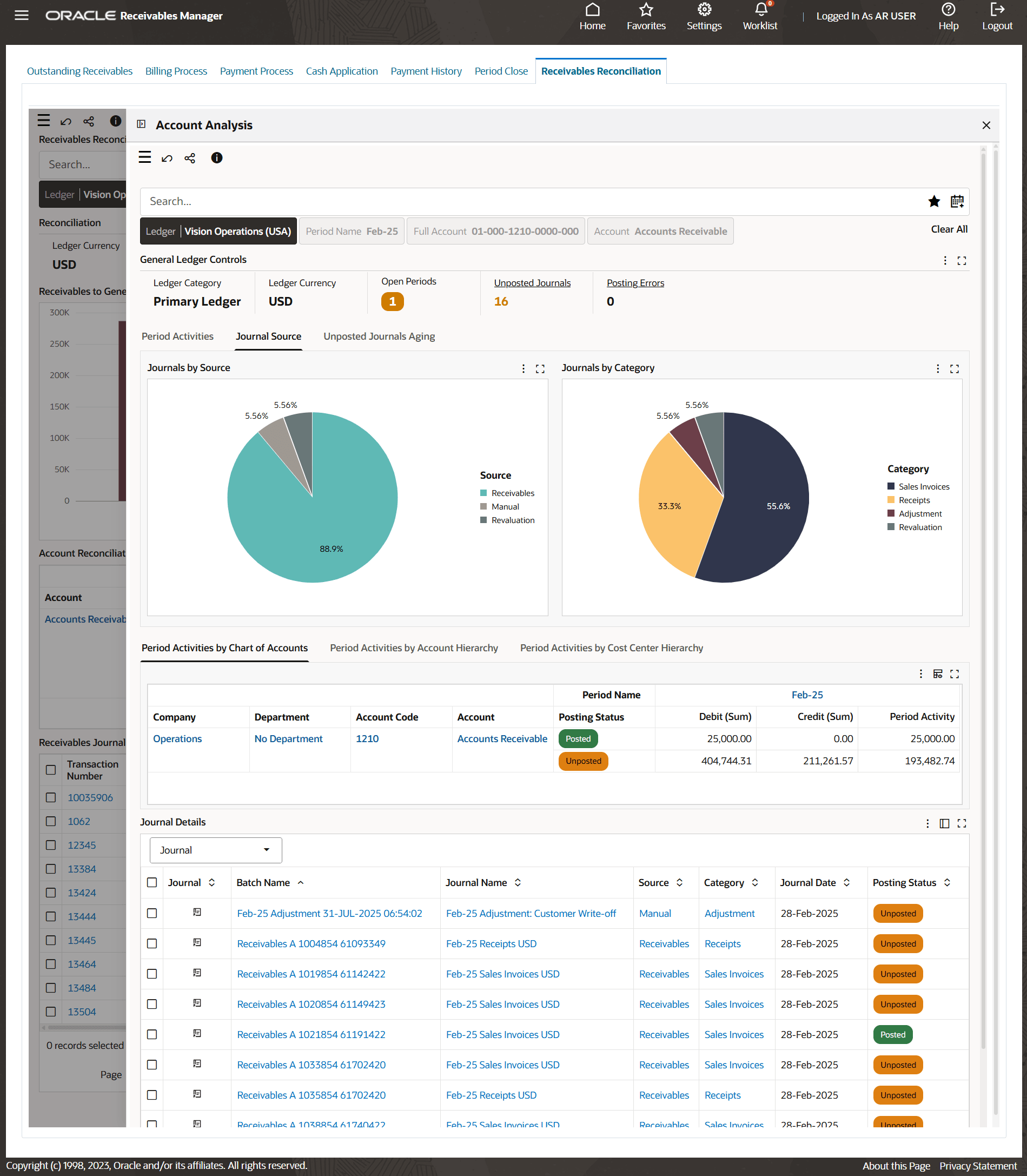

Receivables teams can drill into the General Ledger Account Analysis dashboard to journal details to investigate the discrepancies between Receivables and General Ledger Balances

Drill into Account Analysis Dashboard

Business Benefits

- Reconciliation Insights and Transparency: A centralized dashboard consolidates the reconciliation process, providing a clear view of subledger-to-GL alignment. Users can quickly identify mismatches between Receivables and the General Ledger and drill down from high-level discrepancies into specific transactions, receipts, or adjustments, reducing reliance on multiple fragmented reports.

- Accelerated Audit Readiness: Linking AR transactions directly to journal entries ensures strong audit trails. This capability speeds up issue resolution and strengthens compliance by making supporting details easily accessible during audits.

- Strengthened Cross-Team Collaboration: A shared, real-time view of reconciliation status and exceptions fosters better coordination between AR and GL teams. This alignment minimizes back-and-forth communication and enhances overall efficiency in resolving discrepancies.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

Data Security

- Data available in the dashboards is subject to the same data security approach as core E-Business applications

- Data Access is controlled based on:

- MO: Operating Unit

- MO: Security Profile

- On top of MOAC security, segment security is applied

- Adding Segment Value Security as an additional data security layer beyond MOAC, provides the following value and benefits:

- Granular Access Control: While MOAC restricts data access at the operating unit level, Segment Value Security allows control at a much finer level — for example, individual cost centers or account segments

- Consistent Security Across EBS and ECC: When ECC reflects flexfield values (e.g., Account, Department, or Product)

Data Load

- Data Loads need to be run using the Receivables Command Center Data Load concurrent program

- Full Load

- Can be scheduled to run upon business need

- Supported languages

- Incremental Load

- Will update all receivables data sets

- Languages inherited from the last successful full load

Key Resources

- Receivables Command Center User Guide

- Receivables Command Center Implementation Guide

Access Requirements

You do not need any new role or privilege access to use this feature