3. Administration User

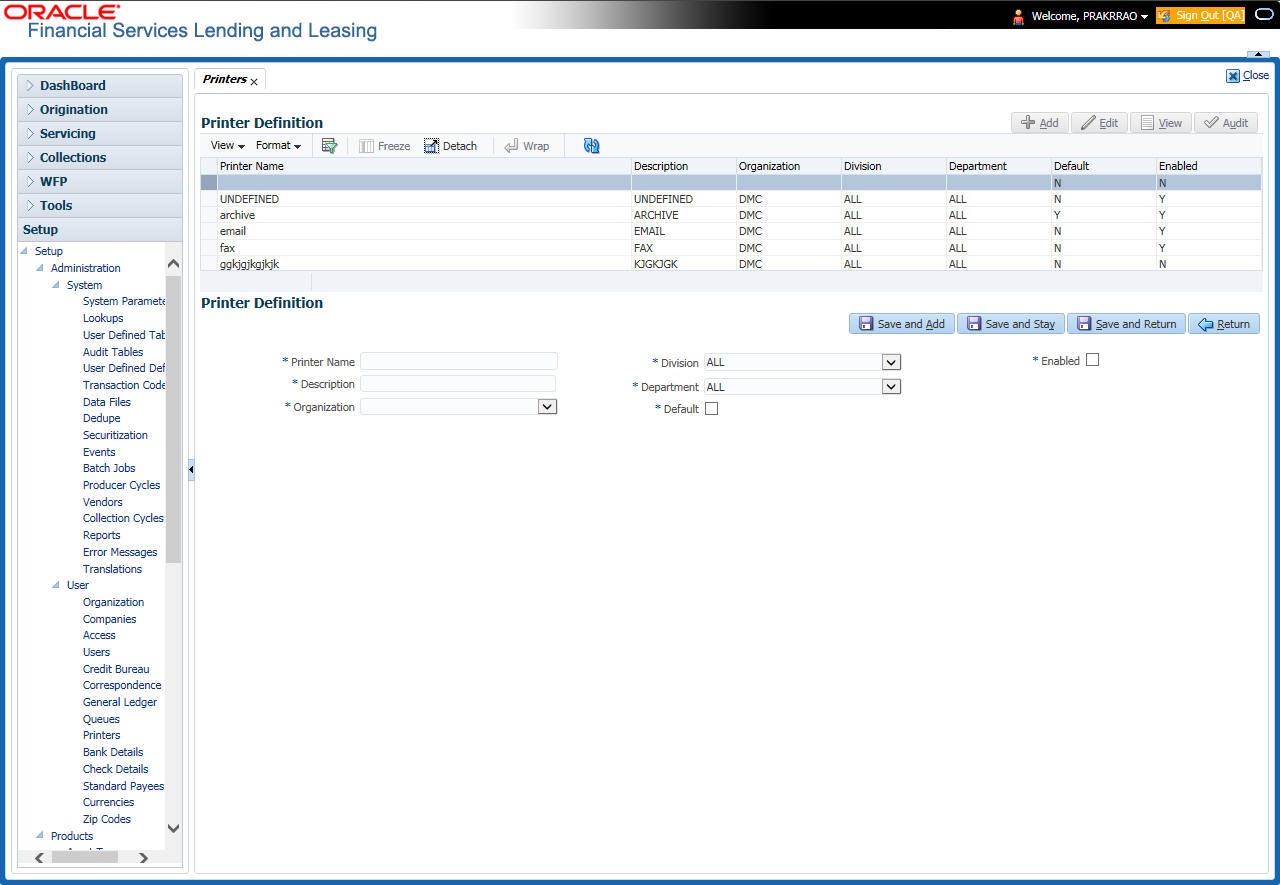

In the Administration > User, you can record setup data that define your organization structure and its users. Information in this link is more “data” related, whereas the information stored on the System drop-down link functions more like switches that control system behavior.

Navigating to Administration User

- On the Oracle Financial Services Lending and Leasing home screen, click Setup > Setup > Administration > User.

The User drop-down link records the following data:

- Organization

- Companies

- Access

- Users

- Credit Bureau

- Correspondence

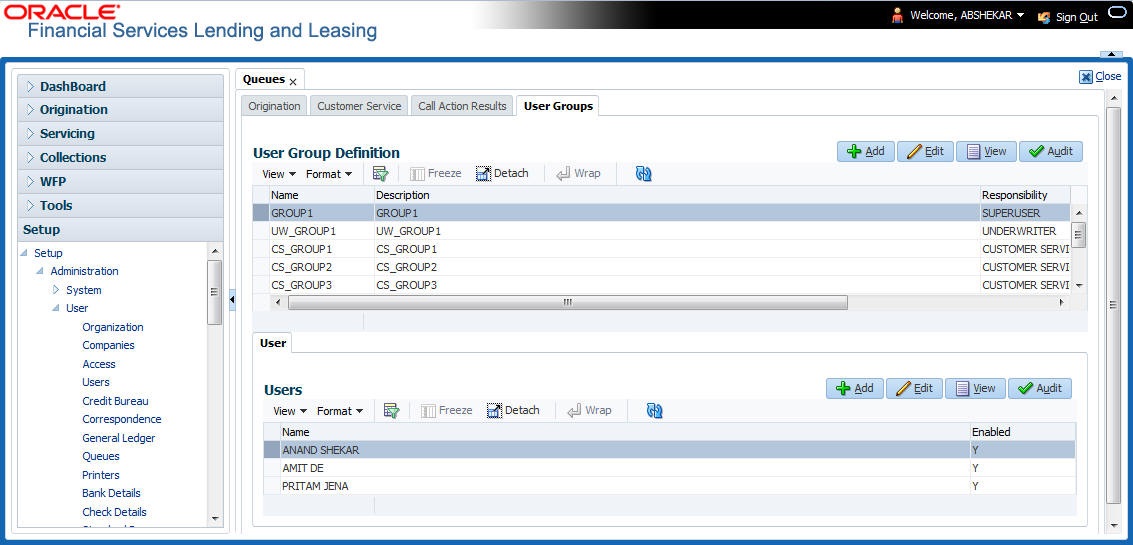

- Queues

- Printers

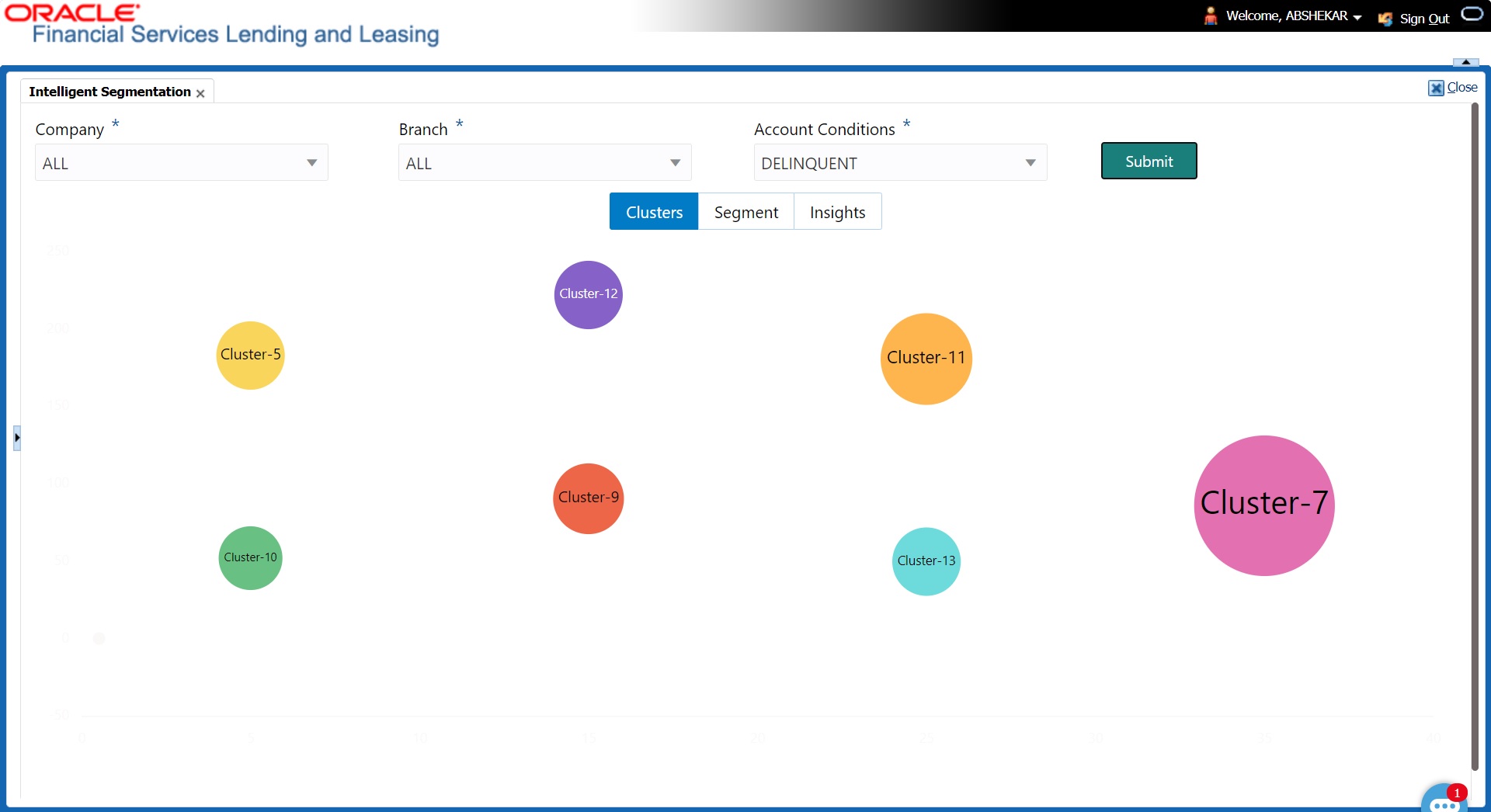

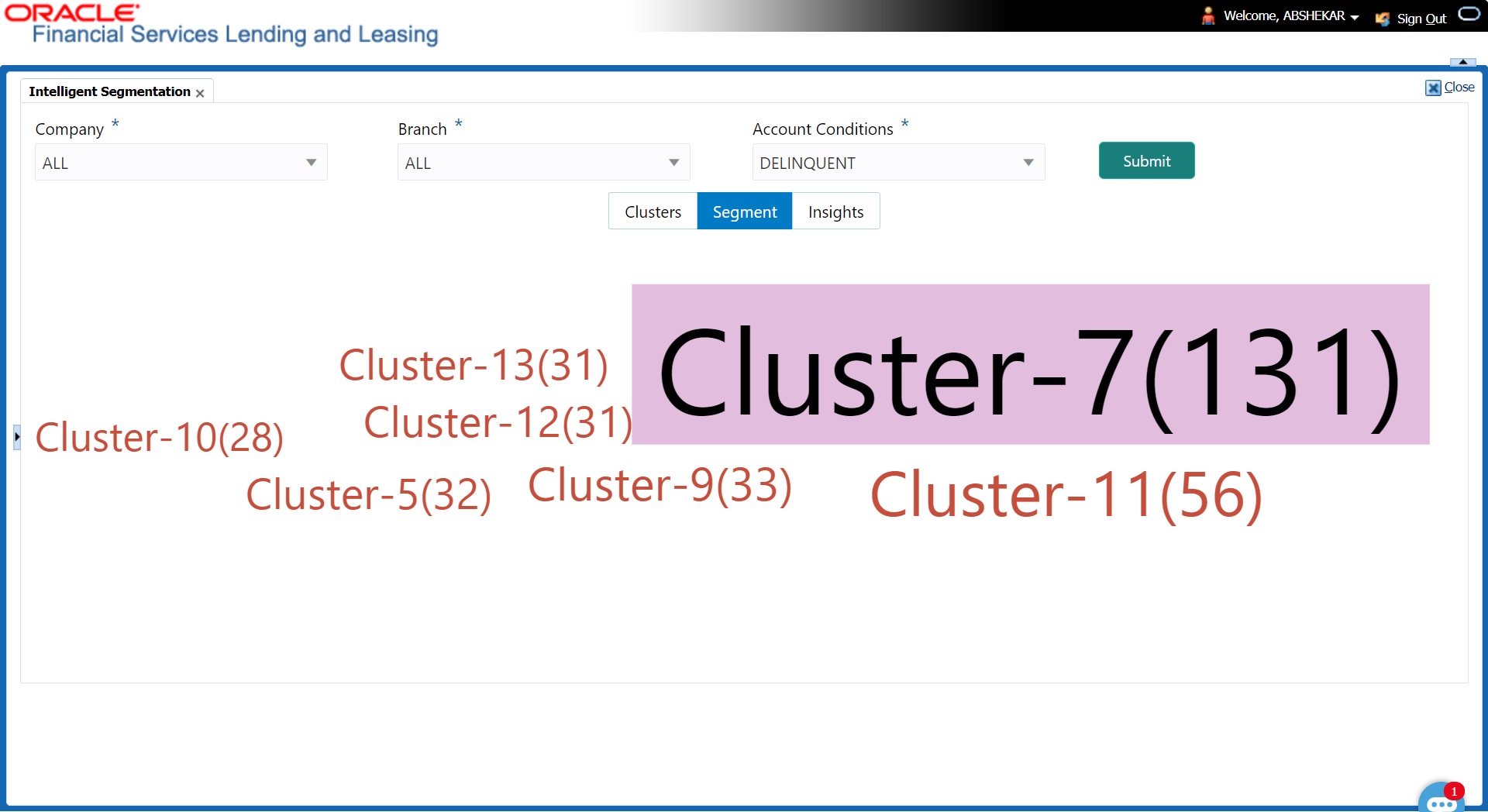

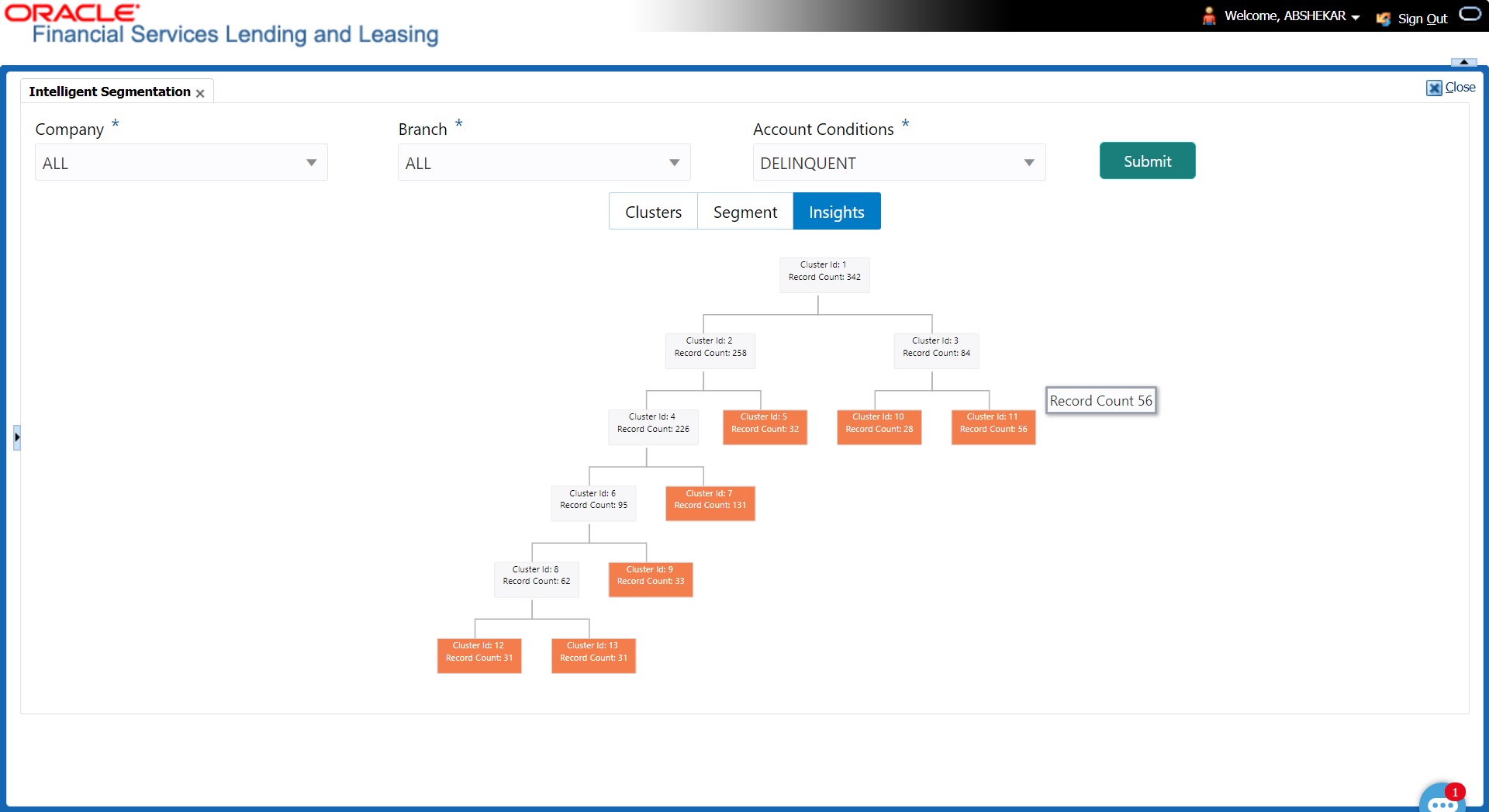

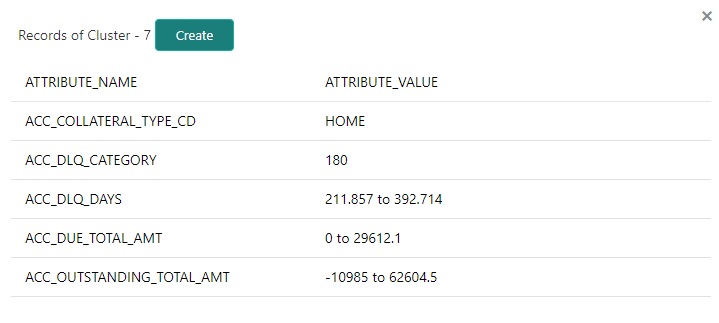

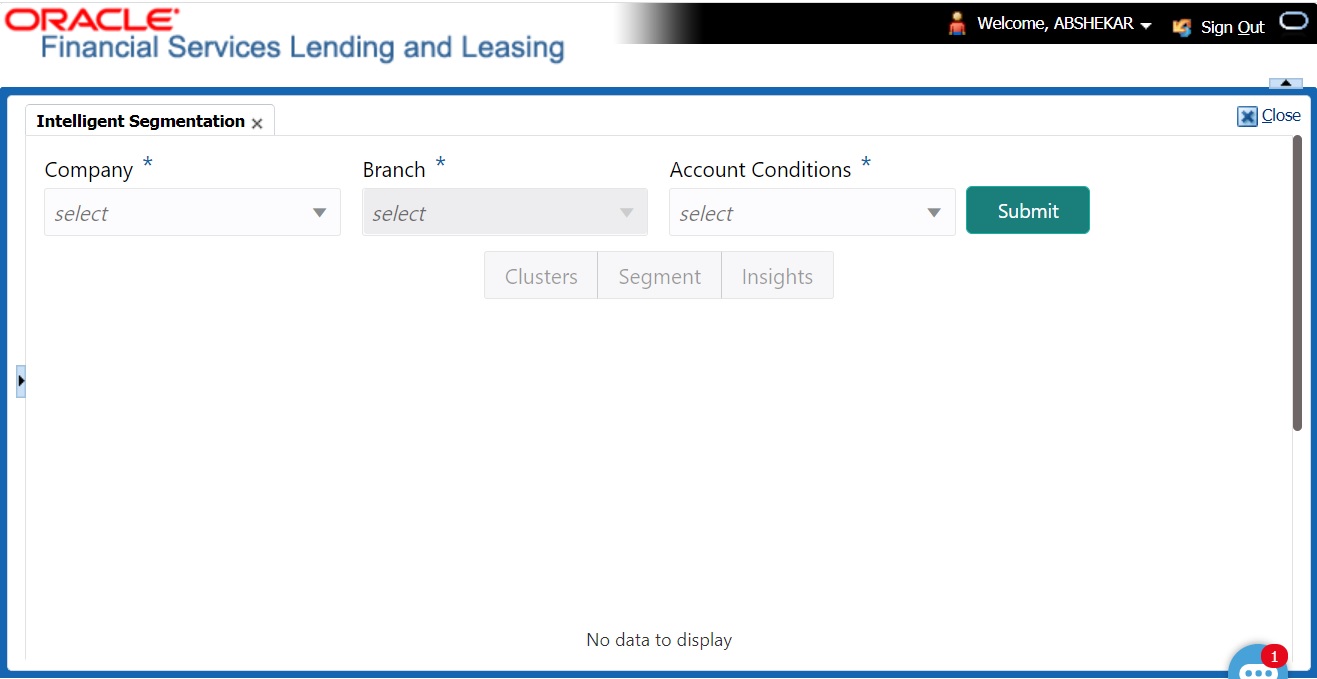

- Intelligent Segmentation

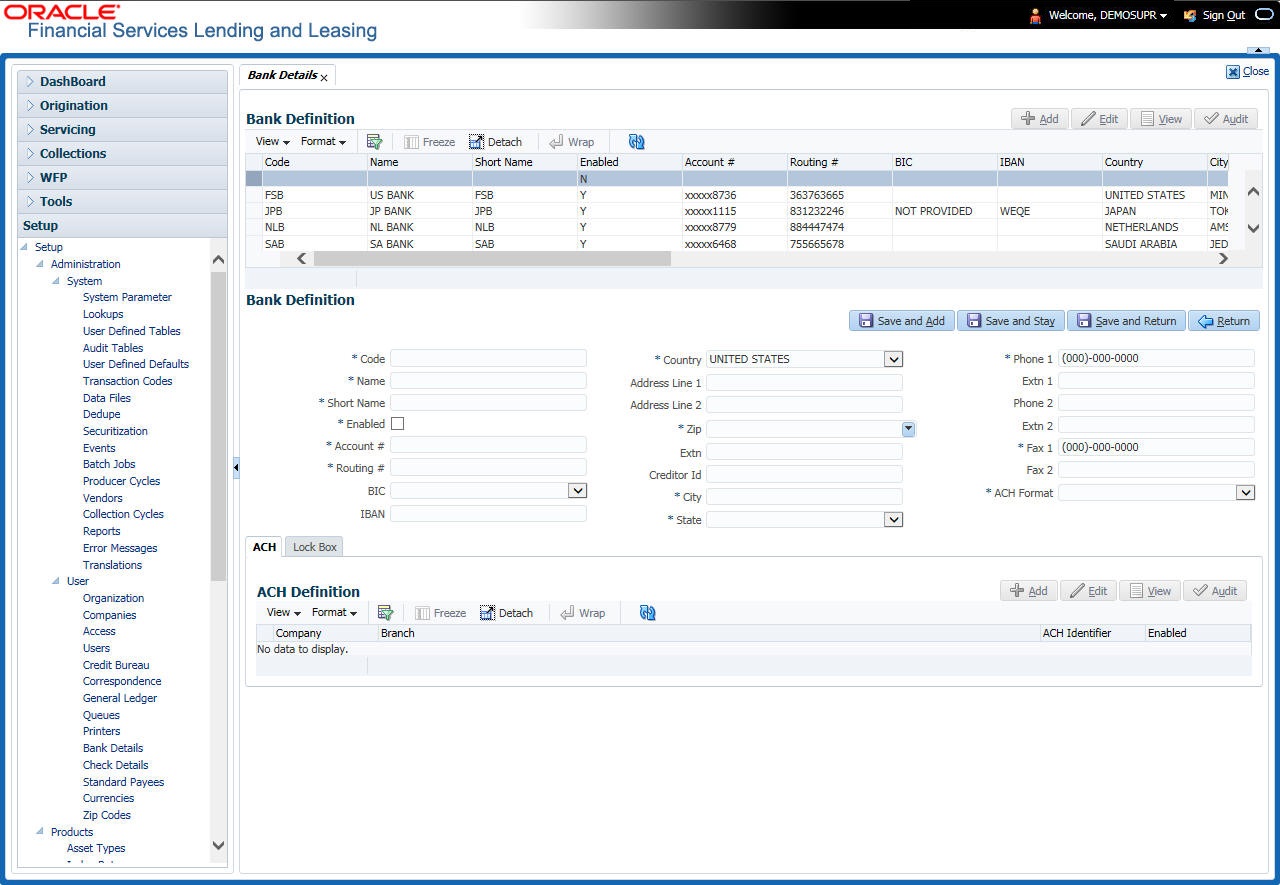

- Bank Details

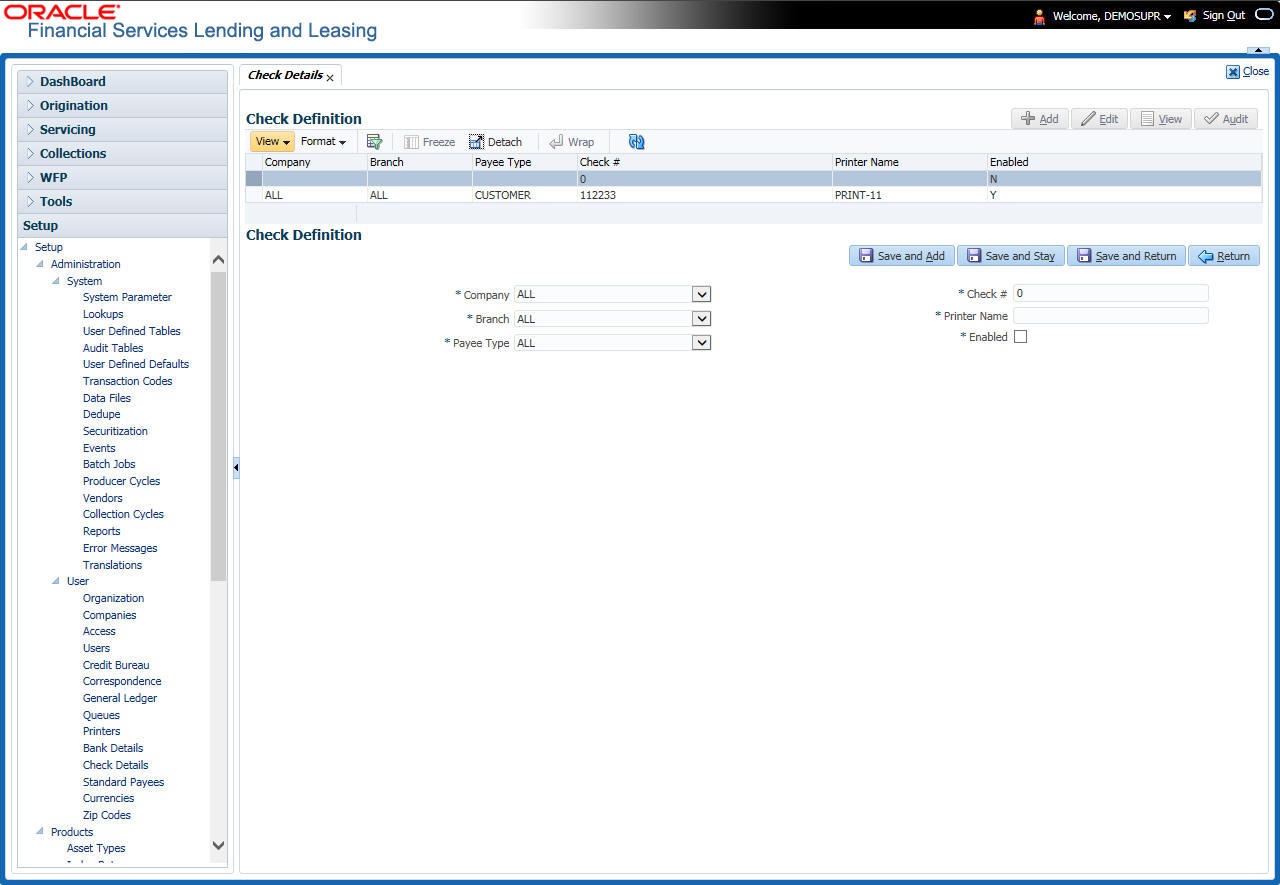

- Check Details

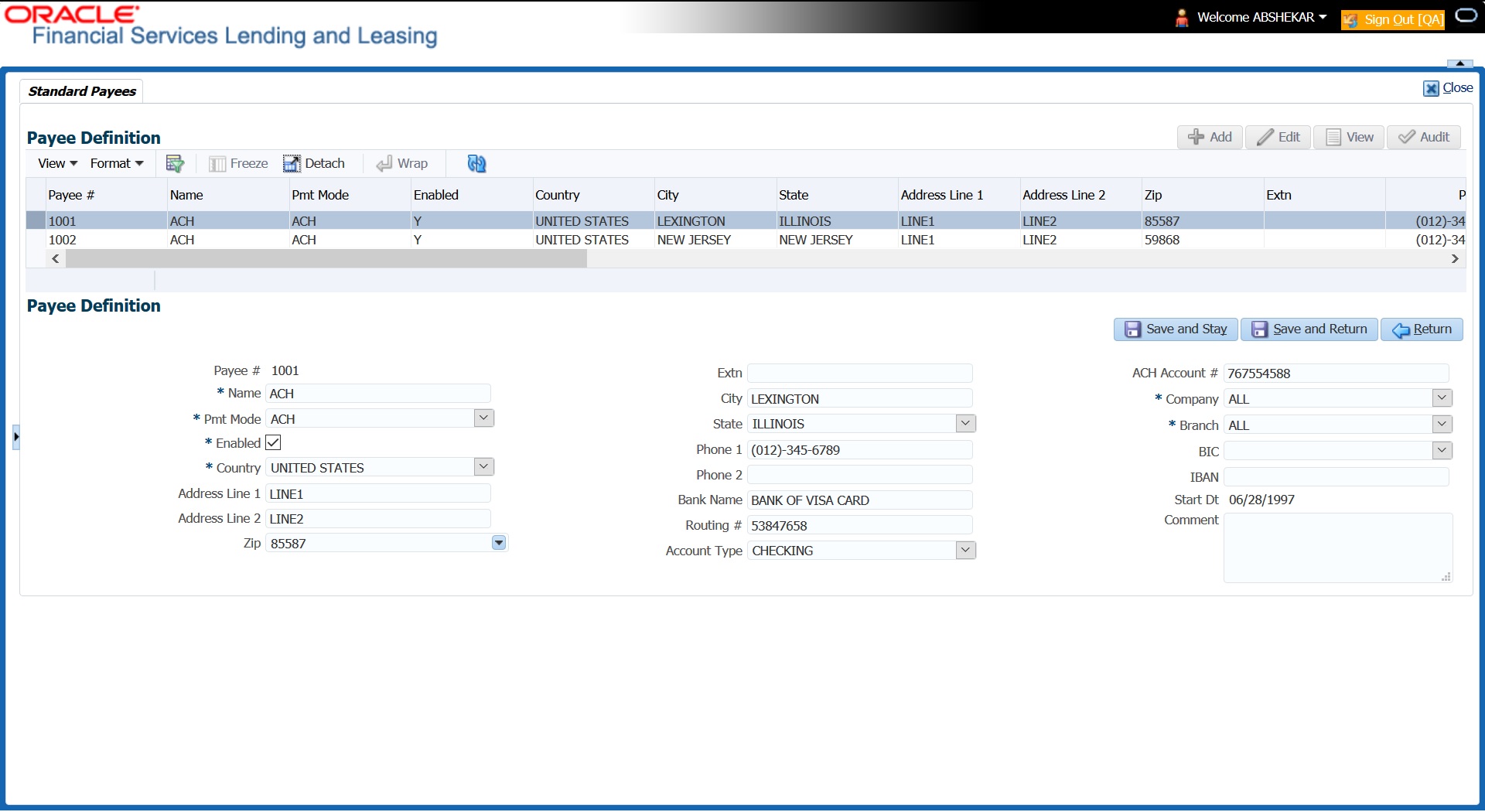

- Standard Payees

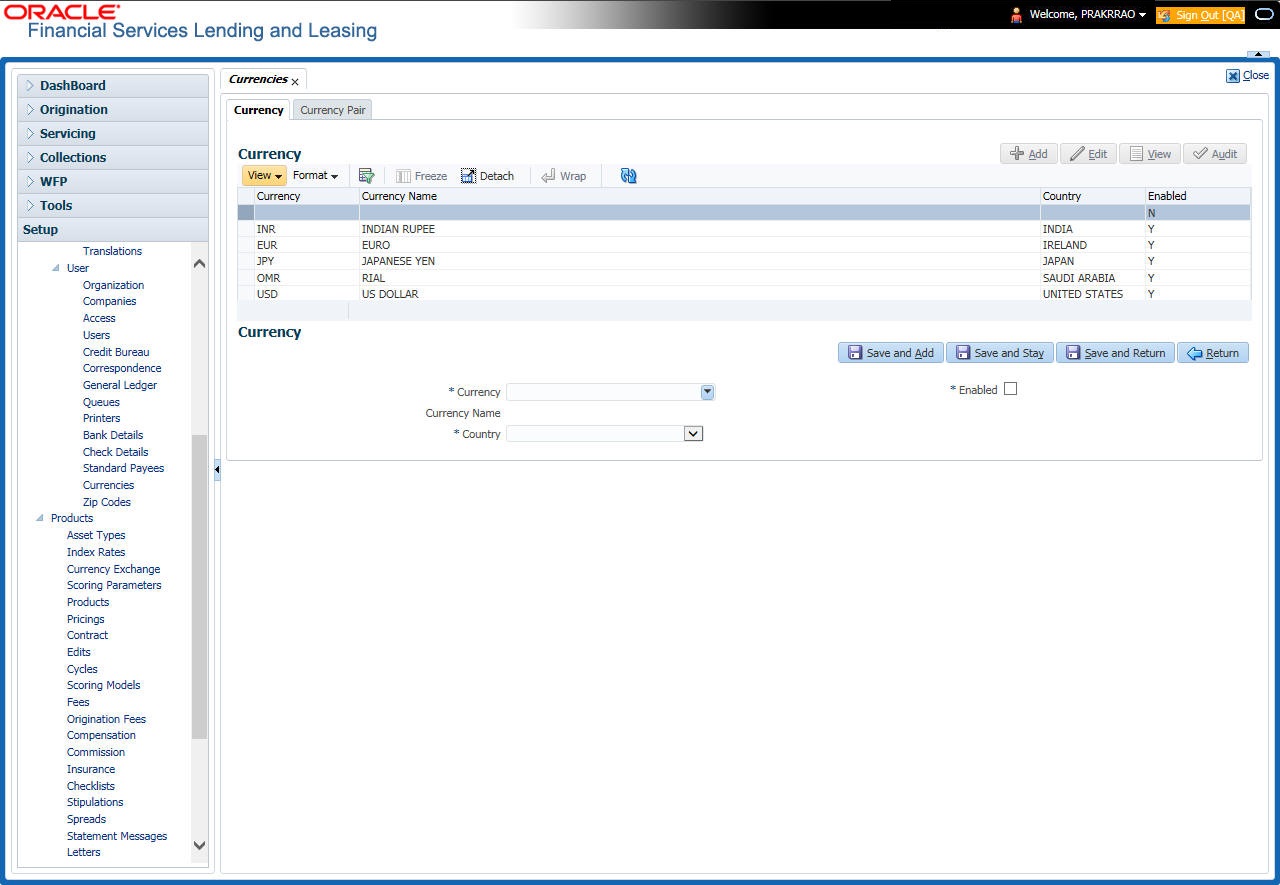

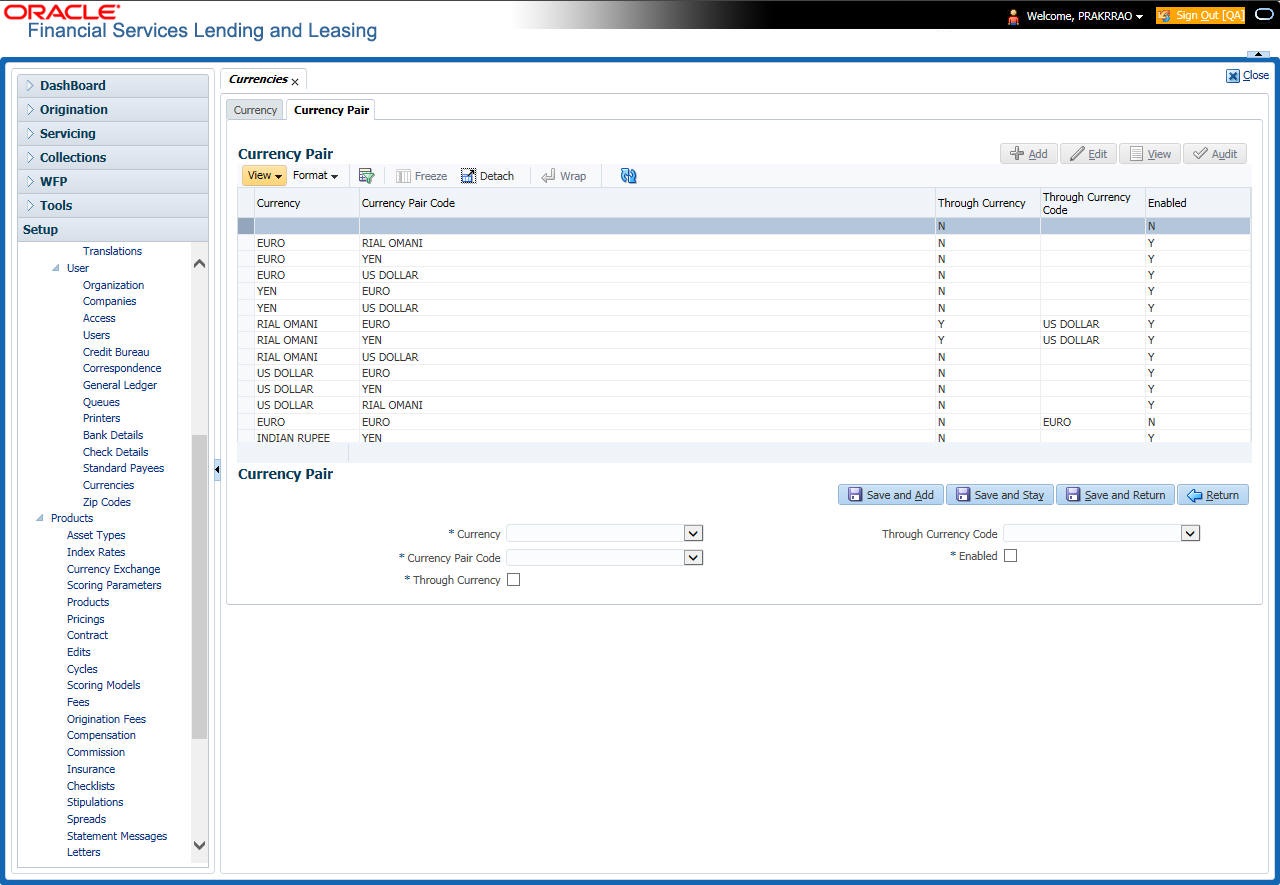

- Currencies

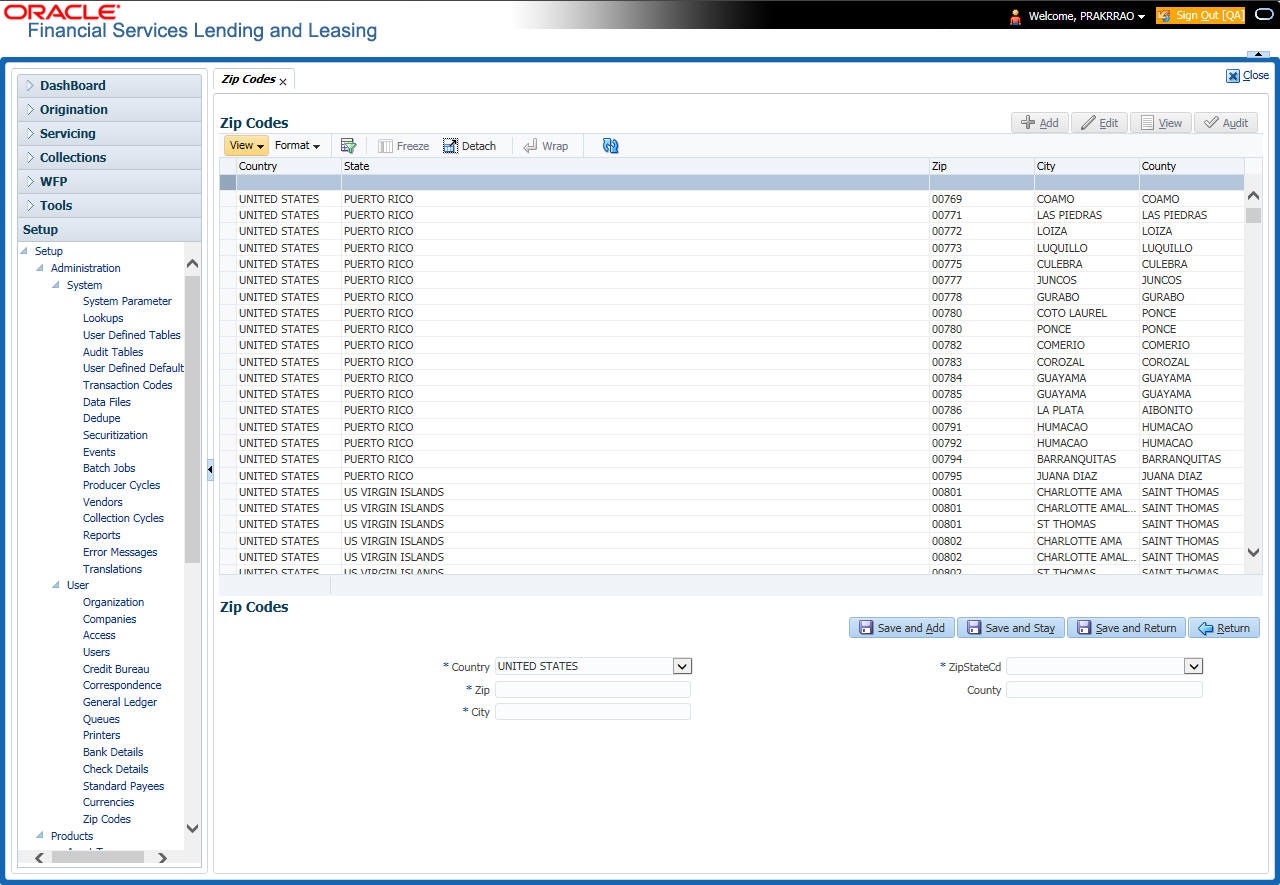

- ZipCodes

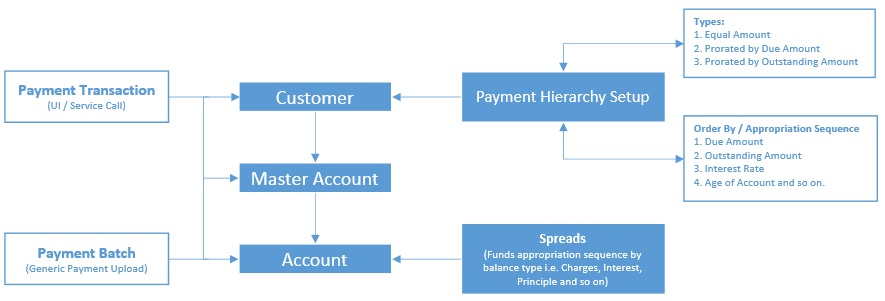

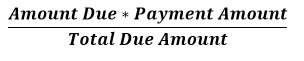

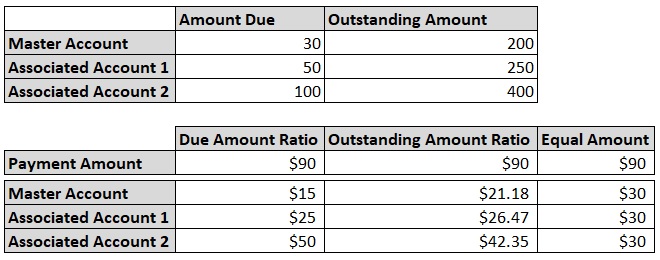

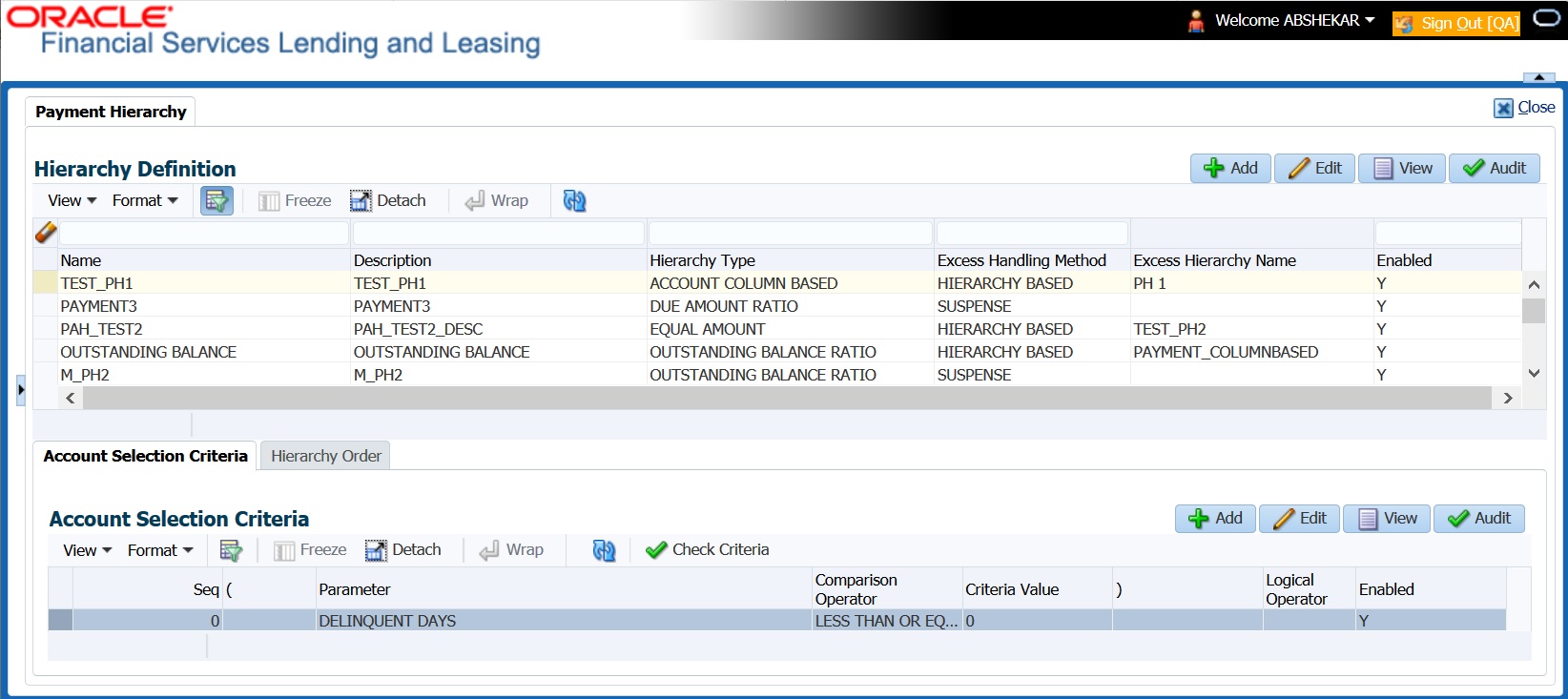

- Payment Hierarchy

3.1 Organization

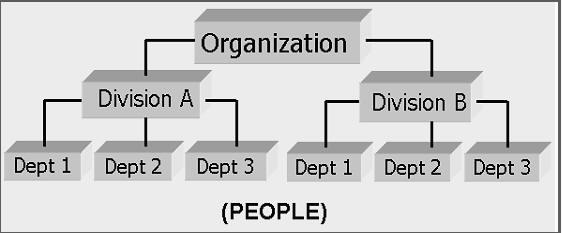

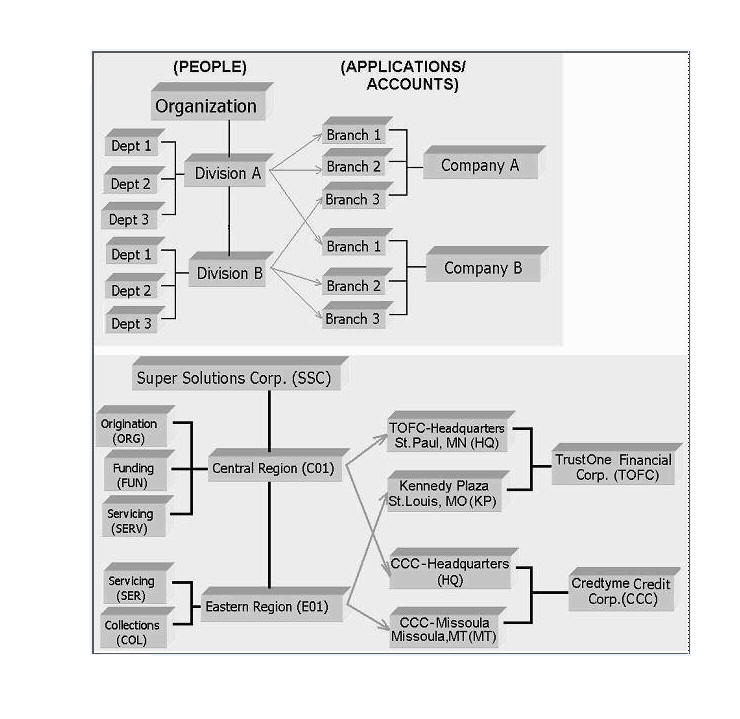

The Organization screen records the operational hierarchy of your business in terms of people. It groups the human resources of your business in three categories: organization, division, and department. The system uses this data to control access of users to applications (The Companies screen allows you to setup the location of these applications.)

Note

You can have only one active organization, so use the Organization field to define your organization at its highest level.

Divisions are groups within your organization that will have access to the same applications. Larger organizations often define their divisions by region. Smaller organizations may define division as branch offices or even departments, and might only have one division defined.

Departments are smaller units within a division. They expand on who is in the corresponding Division field. The system uses this sub screen, for example, when setting up the Services screen on the Utility form. At least one department must be defined for each division.

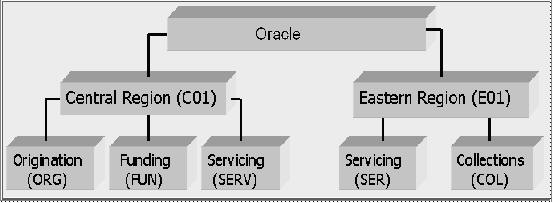

As an example of an organization setup, Oracle Corp. might be defined as:

Organization: O-0001 Oracle Corp. ORA

Division: OD-001 Central Region C01

Department: ODD-01 Origination ORG

Department: ODD-02 Funding FUN

Department: ODD-03 Servicing SER

Division: OD-002 Eastern Region E01

Department: ODD-11 Servicing SER

Department: ODD-12 Collection COL

Note

The Short Name field on the Organization screen allows you to create the ID that Oracle Financial Services Lending and Leasing will use when referring to the organization, division, and department throughout the system.

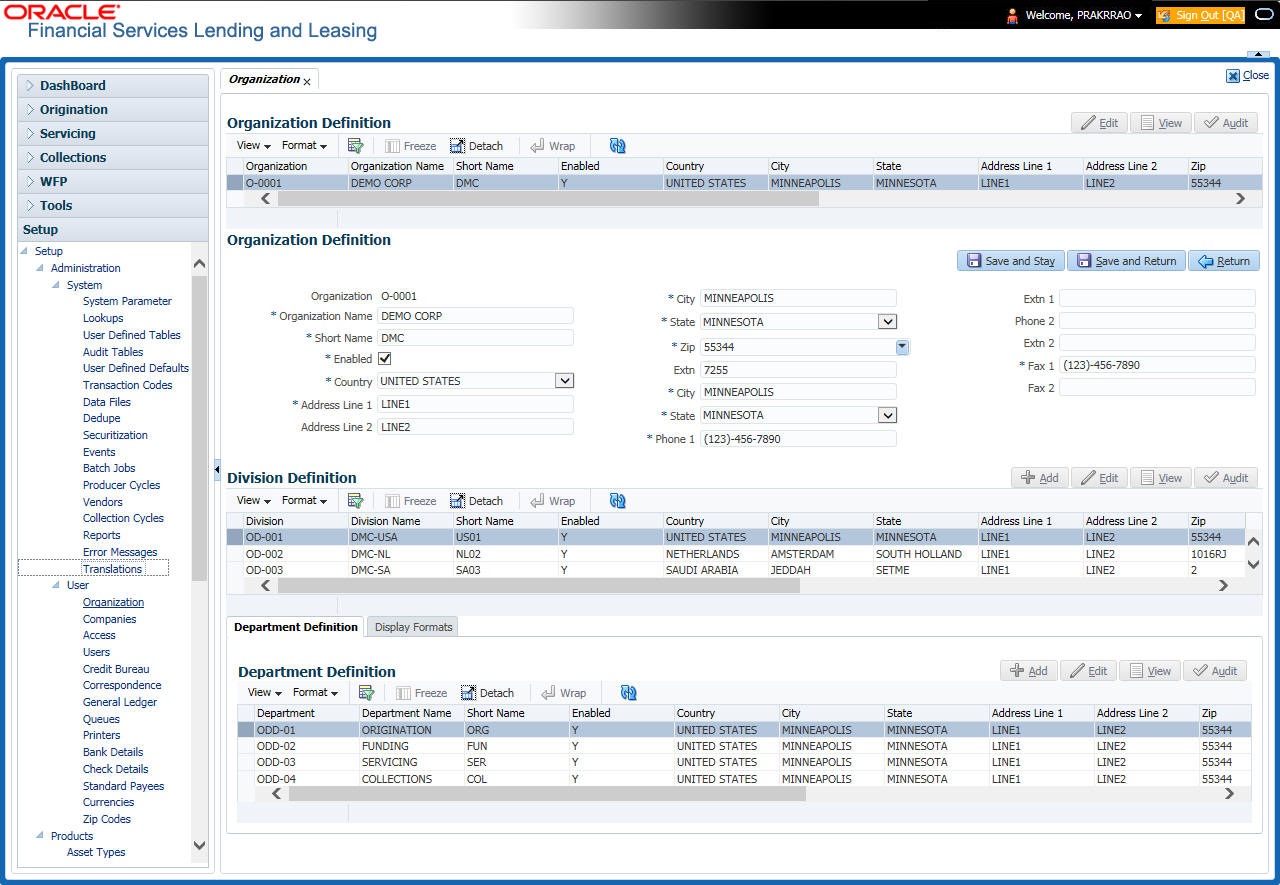

To setup the Organization screen

- Click Setup > Setup > Administration > User > Organization.

- In the Organization Definition section, there can be only one active entry, so use this screen to define your organization at its highest level. Perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Organization |

Specify the organization ID (the ID is the unique identifier used internally by Oracle Financial Services Lending and Leasing to represent your organization). Note: Do not edit this field. |

Organization Name |

Specify the organization name. |

Short Name |

Specify the short name for the organization. Note: This ID represents this organization throughout the system. |

Enabled |

Check this box to enable the organization. Note: Only one enabled organization is currently allowed by Oracle Financial Services Lending and Leasing. |

Country |

Select the country where the organization is located from the drop-down list. |

City |

Specify the city where the organization is located. |

State |

Select the state where the organization is located from the drop-down list. |

Address Line 1 |

Specify the address line 1 for the organization. |

Address Line 2 |

Specify the address line 2 for the organization. |

Zip |

Select the zip code of the location where the organization is located from the drop-down list. |

Extn |

Specify the extension of the selected zip code. |

Phone 1 |

Specify the primary phone number for the organization. |

Extn 1 |

Specify the phone extension for the primary phone number. |

Phone 2 |

Specify the alternate phone number for the organization . |

Extn 2 |

Specify the phone extension for the alternate phone number, if specified. |

Fax 1 |

Specify the primary fax number for the organization. |

Fax 2 |

Specify the alternate fax number for the organization. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

- In the Division Definition section, you can setup the information for the groups within your organization that will have access to the same applicationsPerform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Division |

Specify the division ID. The ID is the unique identifier used internally by the system to represent the division within the organization. Note: Once specified, do not edit this field. |

Division Name |

Specify the division name. |

Short Name |

Specify the short name for the division. Note: This ID represents this division throughout the system (required). |

Enabled |

Check this box to enable the division. |

Country |

Select the country where the division is located from the drop-down list. |

City |

Specify the city where the division is located. |

State |

Select the state where the division is located from the drop-down list. |

Address Line 1 |

Specify the address line 1 for the division. |

Address Line 2 (unlabeled) |

Specify the address line 2 for the division. |

Zip |

Select the zip code of the location where the division is located from the drop-down list. |

Extn |

Specify the extension of the selected zip code. |

Phone 1 |

Specify the primary phone number for the division. |

Extn 1 |

Specify the extension for the primary phone number. |

Phone 2 |

Specify the alternate phone number for the division. |

Extn 2 |

Specify the extension for the alternate phone number . |

Fax 1 |

Specify the primary fax number for the division. |

Fax 2 |

Specify the alternate fax number for the division. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

- Click Setup > Setup > Administration > User > Organization > Department Definition.

- On the Department Definition section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Department |

Specify the department ID. Note: The ID is the unique identifier used internally by the system to represent the department within the division. |

Department Name |

Specify the department name. |

Short Name |

Specify the short name for the department. Note: This is the ID that appears throughout the system to represent this department. |

Enabled |

Check this box to enable the department. |

Country |

Select the country where the department is located from the drop-down list. |

City |

Specify the city where the department is located. |

State |

Select the state where the department is located from the drop-down list. |

Address Line 1 |

Specify the address line 1 for the department. |

Address Line 2 |

Specify the address line 2 for the department. |

Zip |

Select the zip code where the department is located from the drop-down list. |

Extn |

Specify the zip extension where the department is located. |

Phone 1 |

Specify the primary phone number for the department. |

Extn 1 |

Specify the phone extension for the primary phone number. |

Phone 2 |

Specify the alternate phone number for the department. |

Extn 2 |

Specify the phone extension for the alternate phone number. |

Fax 1 |

Specify the primary fax number for the department. |

Fax 2 |

Specify the alternate fax number for the department. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

- Click Setup > Setup > Administration > User > Organization > Display Format.

- On the Display Format section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Format Type |

Select the type of format from the drop-down list. |

Format Sub Type |

Select the sub type of the format from the drop-down list. The format sub type will be displayed based on the format type selected. |

Format |

Specify or select the format based on the format type and format sub type selected. For Date and Time Zone format, select the required option from the drop-down list. |

Format Mask |

Specify the format mask. |

Format Filler |

Specify the format filler. |

Special Data |

Specify the special data, if any. |

Enabled |

Check this box to enable the display format. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

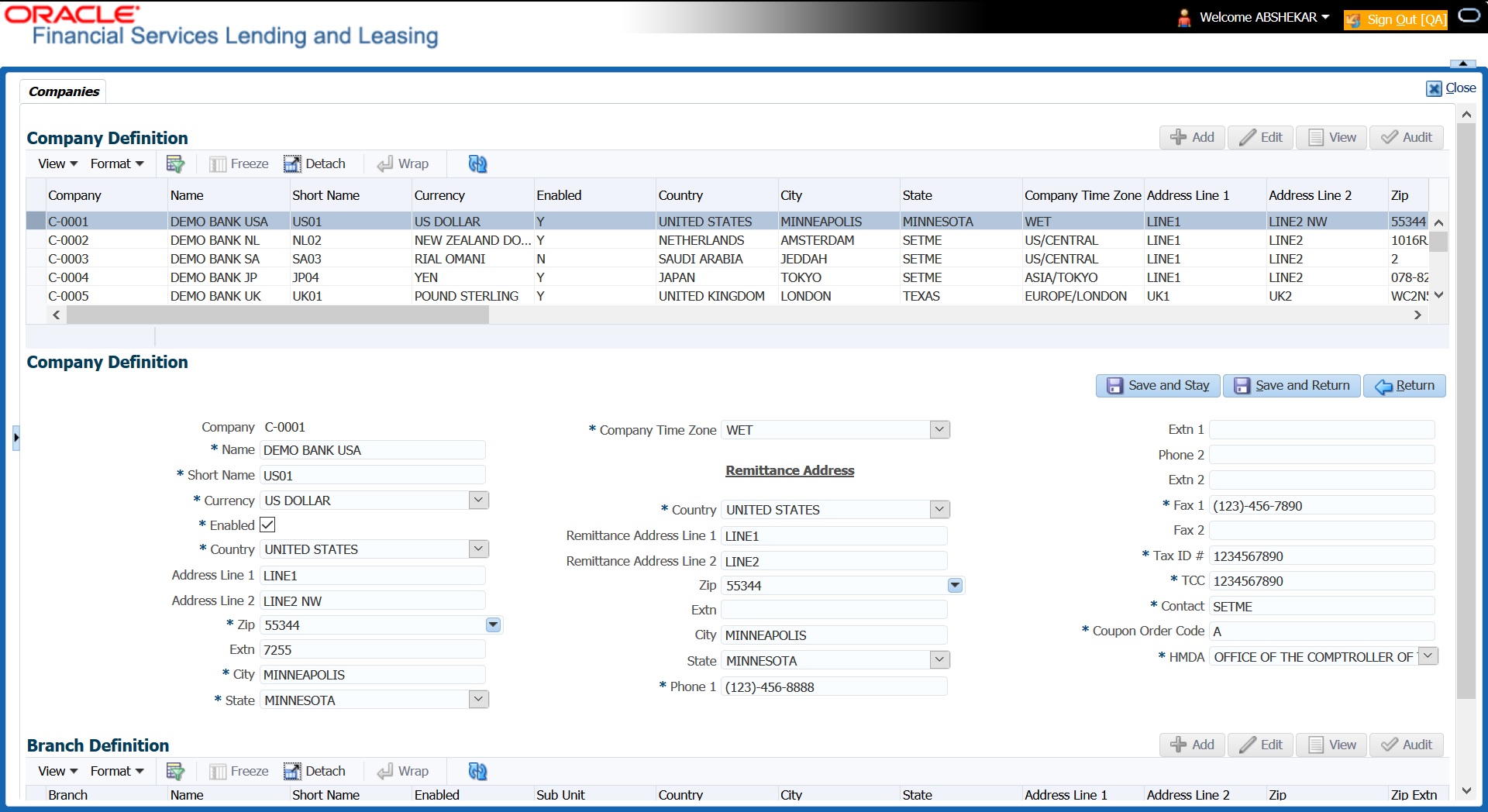

3.2 Companies

The Companies screen records the hierarchical structure of your portfolio companies and their branches. Just as Oracle Financial Services Lending and Leasing uses the Organization screen to determine the location of people, it uses the information on the Companies screen to determine the location of applications. In completing the Companies screen, there can be more than one company, and each company can have more than one branch.

Accounting is performed at the company level. Applications can be sorted down to the branch level. For this reason, branches are set up to reflect different business practices. You would set up different branches if, for example:

- The General Ledger (GL) differs between branches

- The branches work with different accounts

- There is a difference between branches in terms of the tasks they perform (line of credit origination, servicing, collections, and so on)

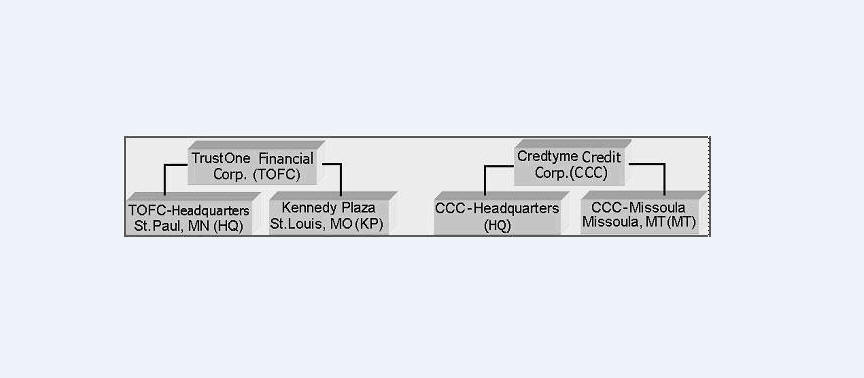

As an example of the companies setup, Oracle Corp. might have the following companies and branches defined as:

Company: C-0001 TrustOne Financial Corp TOFC

Branch: CB-01 TOFC - Headquarters HQ

Branch: CB-02 Kennedy Plaza KP

Company: C-0002 Credtyme Credit Corp CCC

Branch: CB-11 CCC - Headquarters HQ

Branch: CB-12 CCC - Missoula MT

Note

- The system does not limit the number of companies or associated branches with the company you can enter.

- The Short Name field on the Companies screen allows you to create the ID that the system will use while referring to the company and branch.

Key concept: Note the difference between the Company screen and the Organization screen:

- On the Organization screen, Oracle Financial Services Lending and Leasing users belong to an organization and division.

- On the Companies screen, credit applications belong to a company and branch.

As you can see in the following Access screen section, the information on the Organization and Companies screens define the operational hierarchy of your companies in terms of which Oracle Financial Services Lending and Leasing users will have access to which applications

To setup the Companies

- Click Setup > Setup > Administration > User > Companies. The Companies screen defines entities within your organization that originate and/or service Line of Credit.

- In the Company Definition section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Company |

Specify the portfolio company ID. (This ID is the unique identifier used internally by the system to represent the company). |

Name |

Specify the name of the portfolio company (required). |

Short Name |

Specify the short name for the portfolio company (ID displayed to represent the company). |

Currency |

Select the currency of the portfolio company from the drop-down list. The system displays the default value as ‘US DOLLAR’. |

Enabled |

Check this box to enable the portfolio company. |

Country |

Select the country where the portfolio company is located from the drop-down list. The system displays the default value as ‘UNITED STATES’. |

Address Line 1 |

Specify the address line 1 for the portfolio company. |

Address Line 2 |

Specify the address line 2 for the portfolio company. |

Zip |

Select the zip code of the location where the portfolio company is located from the drop-down list. |

Extn |

Specify the extension of the zip code where the portfolio company is located. |

City |

Specify the city where the portfolio company is located. |

State |

Select the state where the portfolio company is located from the drop-down list. |

Company Time Zone |

Select the time zone in which the company operates using the drop-down list. This time zone is considered if system is setup to process GL at Company level. For more information, refer to ‘Appendix - Configuration at Company Level’ chapter. |

Remittance Address section |

|

Country |

Select the remittance address country from the drop-down list. The system displays the default value as ‘UNITED STATES’. |

Remittance Address 1 |

Specify the remittance address line 1, if it is different from the company address. This address is included as the remittance address on statements. |

Remittance Address 2 |

Specify the remittance address line 2. |

Zip |

Select the zip code of the remittance address line 1 from the drop-down list. |

Extn |

Specify the extension of the remittance address zip code. |

City |

Specify the remittance address city. |

State |

Select the remittance address state from the drop-down list. |

Phone 1 |

Specify the primary phone number for the portfolio company. |

Extn 1 |

Specify the phone extension for the primary phone number. |

Phone 2 |

Specify the alternate phone number for the portfolio company. |

Extn 2 |

Specify the phone extension for the alternate phone number. |

Fax 1 |

Specify the primary fax number for the portfolio company. |

Fax 2 |

Specify the alternate fax number for the portfolio company. |

Tax ID # |

Specify the tax identification number for the portfolio company. |

TCC |

Specify the transmitter control code for the portfolio company (1098 Electronic Filing). |

Contact |

Specify the contact information about the portfolio company. |

Coupon Order Code |

If you are using coupons, Specify the coupon order code to be used by a third party printing the coupons for billing statements. |

HMDA |

Select the HMDA agency (Home Mortgage Disclosure Act reporting agency for the company). |

- Perform any of the Basic Actions mentioned in Navigation chapter.

- On the Branch Definition section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Branch |

Specify the portfolio branch ID. (This ID is the unique identifier used internally by the system to represent the branch within your company). |

Name |

Specify the name of the portfolio branch (required). |

Short Name |

Specify the short name for the portfolio branch (ID displayed to represent the branch) (required). |

Enabled |

Check this box to enable the portfolio branch. |

Sub Unit |

Select the Sub Unit from the drop-down list. Sub Unit refers the entity which is the source of funds for the credit application/Account. System associates the selected sub unit with the particular company/branch combination and displays by default when the same is selected during an application/Account creation. |

Country |

Select the country from the drop-down list. The system displays the default value as ‘UNITED STATES’. |

City |

Specify the city where the portfolio branch is located. |

State |

Select the state from the drop-down list. |

Address Line 1 |

Specify the address line 1 for the portfolio branch. |

Address Line 2 |

Specify the address line 2 for the portfolio branch. |

Zip |

Select the zip code of the location where the portfolio branch is located. |

Zip Extn |

Specify the extension of the zip code, where the portfolio branch is located. |

Phone 1 |

Specify the primary phone number for the portfolio branch. |

Extn 1 |

Specify the phone extension for the primary phone number. |

Phone 2 |

Specify the alternate phone number for the portfolio branch. |

Extn 2 |

Specify the phone extension for the alternate phone number. |

Fax 1 |

Specify the primary fax number for the portfolio branch. |

Fax 2 |

Specify the alternate fax number for the portfolio branch. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

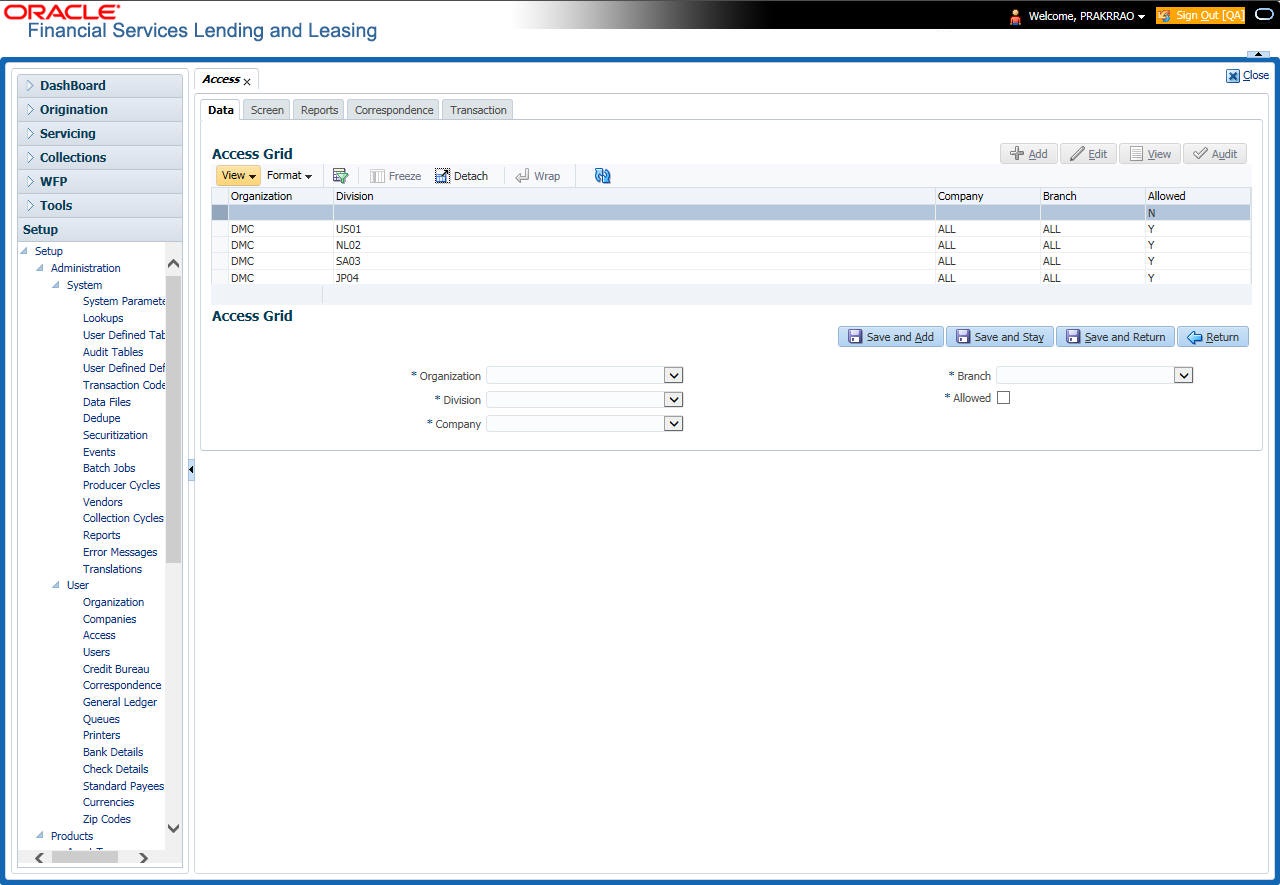

3.3 Access

Using the organizations, divisions, companies, and branches created on the Organization and Companies screens, you can control the access privileges of applications. On the Access screen, you define which organization/division (users) can gain access to which company/branch (applications andaccounts) locations.

Normally, for each division within an organization, you would define a record with Company value of ALL and a Branch value of ALL, then select the Allowed box. You then define other records for the same Organization and Division for other Company and Branch combinations with the Allowed box cleared to restrict access.

To setup the Access

- Click Setup > Setup > Administration > User > Access. The system displays the Access screen. In this screen, you can control the access privileges of the user for the following categories:

- Data

- Screen

- Reports

- Correspondence

- Webservice

3.3.1 Data

The Data screen allows you to restrict access to different data.

To setup the Data

- Click Setup > Setup > Administration > User > Access > Data.

- In the Access Grid section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Organization |

Select the organization for which you are defining access privileges from the drop-down list. |

Division |

Select the division within the organization for which you are defining Access privileges from the drop-down list. |

Company |

Select the portfolio company to which you are defining access privileges for the organization and division specified from the drop-down list. |

Branch |

Select the portfolio branch of the company to which you are defining access privileges for the organization and division specified from the drop-down list. |

Allowed |

Check this box to provide access to the data pertaining to the company and branch, for the organization and division specified. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

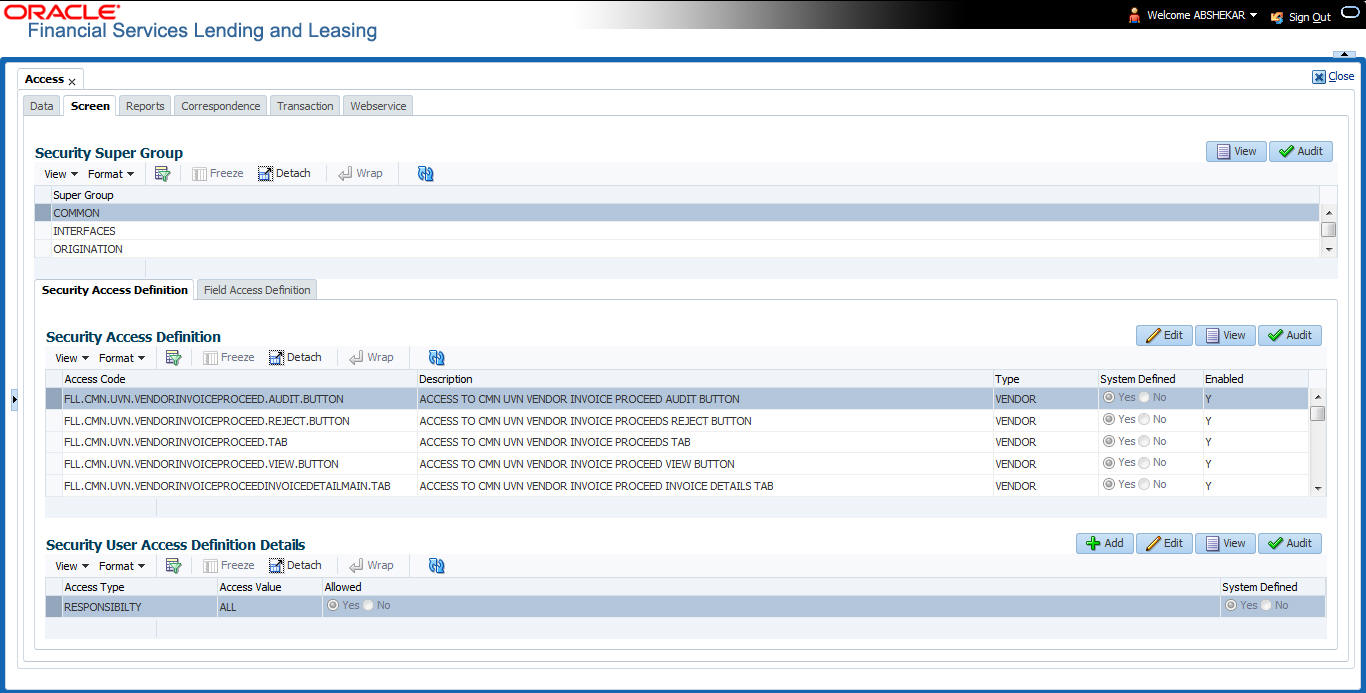

3.3.2 Screen

In the screen, you can control the access to the following:

- Menu – Control access at the application menu level. For example, for Setup menu you can provide access only to an Administrator.

- Screens – Control access to the screens available in the application.

- Buttons – Control access based on the stage.

- Fields - Control access to base and user defined fields.

For example, Add and Edit buttons can be disabled once an application is funded.

If you want to restrict updating the Applicant details, then edit button has to be disabled for the stage.

The screen allows you to restrict access to different screens and fields using the following tabs:

- Security Access Definition

- Field Access Definition

3.3.2.1 Security Access Definition

To set the Screen Security

- Click Setup > Setup > Administration > User > Access > Screen.

- In the Security Super Group section, you can view the details of the super group you want to work with.

- In the Security Access Definition section, perform any of the Basic Operations mentioned in Navigation chapter.

Note

You can not add a new record

A brief description of the fields is given below:

Field: |

Do this: |

Access Code |

The system displays the selected access code. |

Description |

Modify the description of the access code. |

Type |

The system displays the type of security access definition. |

System Defined |

If ‘Yes’ is selected, the security access definition entry is system defined. If ‘No’ is selected, the security access definition entry is manually defined. |

Enabled |

Check this box to enable the security access definition entry is enabled. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

- In the Security User Access Details section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Access Type |

Select the access type of the user who will have access to this screen from the drop-down list. |

Active Value |

Select the active value of the user who will have access to this screen from the drop-down list. |

Allowed |

Select ‘Yes’ to allow access to this screen or ‘No’ to deny access to this screen. |

System Defined |

Select ‘Yes’, if the screen user access definition entry is system defined. Select ‘No’, if the screen user access definition entry is manually defined. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

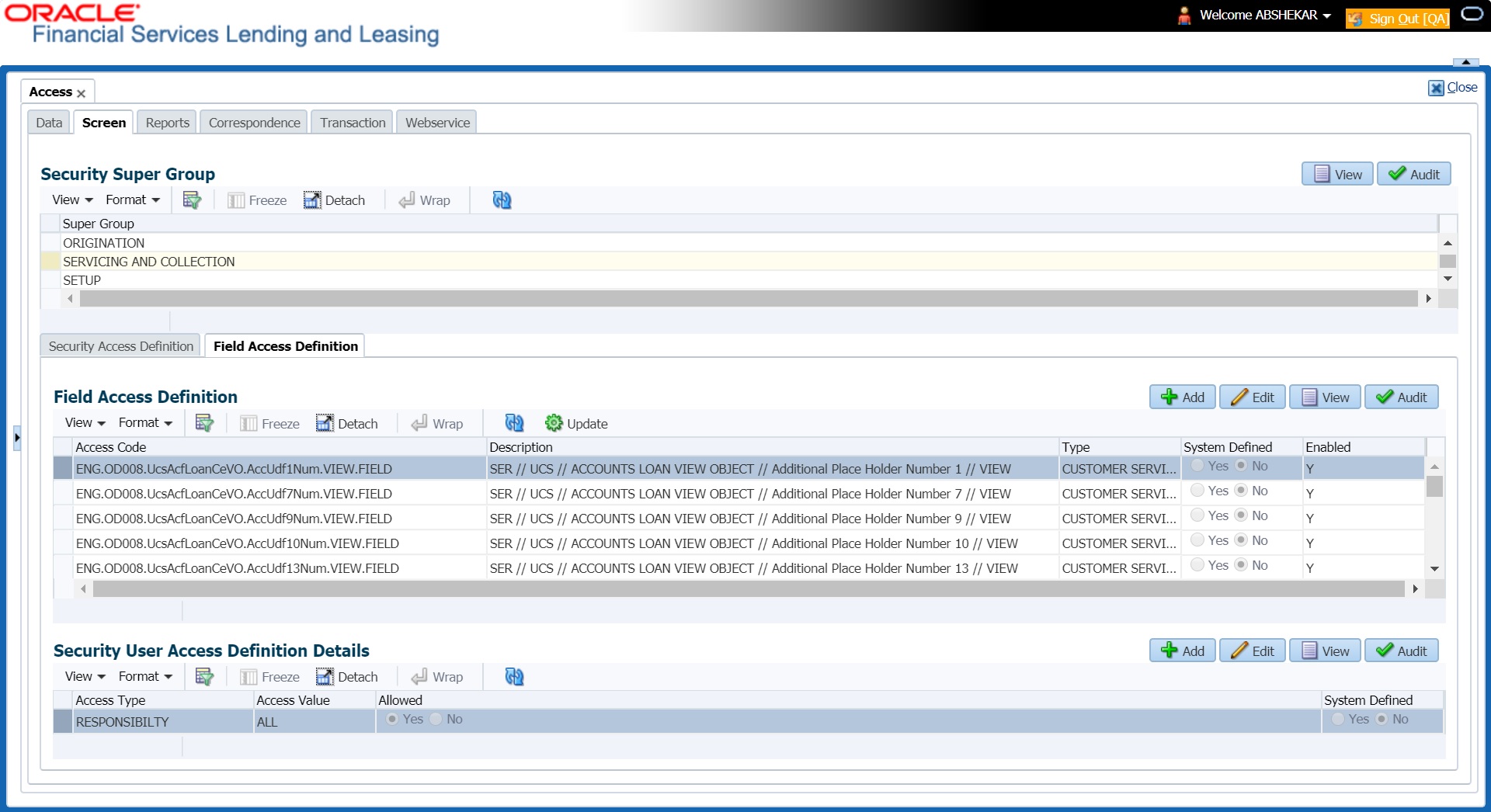

3.3.2.2 Field Access Definition

The Field Access Definition tab facilitates for field customization in the User Interface (UI) screen. In this tab, you can do the following:

- Enable User Defined Fields (UDFs) to be displayed in respective UI which are provided as part of product installation/upgrade

- Allow or restrict user access to base non-mandatory fields and UDFs maintained in the system

- Regroup base fields to another section in UI

Note the following:

- The Field Access Definition tab displays User defined Fields maintained in the system for which you can specifically define access permissions based on user responsibility.

- The base mandatory fields are loaded automatically and Access Responsibility is set to ALL by default during product installation/upgrade. The same cannot be modified and hence are not displayed in this tab.

- Field access and customizations are to be performed at your sole discretion and OFSLL is not responsible for any impact/damage/mismatch in the data being represented or resulting out of this change.

- Field labels can further be customized in Administration > System > Label Configuration screen.

Before defining field access, refer to the table below which indicates the possible combinations of a particular field being displayed and allowed to edit in UI.

View Type |

Access |

Result |

VIEW |

NO |

NON VIEWABLE |

VIEW |

YES |

VIEWABLE AND EDITABLE |

LOCK |

NO |

READONLY |

LOCK |

YES |

VIEWABLE AND EDITABLE |

To add/enable new User Defined Fields

- In the ‘Field Access Definition’ section, click ‘Add’ and populate the following details:

Field:

Do this:

Language

Select the language of the user(s) who will have access to this field from the drop-down list.

Division

Select the division or group within the organization to which the user belongs from the drop-down list.

Object Name

Select the Object Name from the drop-down list. You can use the search option to query based on specific name. The list is populated based on the combination of Language and Division selected above.

Field Name

Select the field to be updated from the drop-down list. The list is displayed based on the object selected.

Access Type

Select the access type as one of the following from the drop-down list.

View - to display and make the field editable.

Lock - to only display the field.

Note: Option defined here takes precedence with the display (Y/N) option selected in Setup > Administration > System > Label Configuration tab.

System Defined

Select ‘Yes’, if the field access definition is system defined.

Select ‘No’, if the field access definition is manually defined.

Enabled

Check this box to enable the field access definition.

- Perform any of the Basic Actions mentioned in Navigation chapter.

- Click ‘Update’. System refreshes the cache and automatically updates the Field Access Details from database to display in header section.

After updating the required changes in screen, you need to logout and re-login for changes to be effective. This is basically to refresh session cache and update Field Access information from database server. Though, there is ‘Update’ option, clicking on the same only refreshes the cache and reloads the record.

To enable/disable Base fields

- In the ‘Field Access Definition’ section, click ‘Edit’ and populate the following details::

Field:

Do this:

Access Code

View the access code defined for the field.

Description

View the access code description. You can modify the details if required.

Type

By default, system displays the name of the group inside which the field is displayed in UI. To move the field to a different group, select the required type from the drop-down list.

System Defined

Select ‘Yes’, if the screen field access definition is system defined.

Select ‘No’, if the screen field access definition is manually defined.

Enabled

Check this box to enable the field access definition.

3.3.2.3 Security User Access Definition Details

The ‘Security User Access Definition Details’ sub tab is available only for base - non mandatory fields and user defined fields. In the ‘Security User Access Definition Details’ sub tab you can defined field access and set restrictions to specific user responsibility.

- In the ‘Security User Access Definition Details’ section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Access Type |

Select RESPONSIBILTY as the access type from the drop-down list since access to field is based on responsibility by default. This field is disabled during edit. |

Active Value |

Select the user role who needs to have access to this field from the drop-down list. |

Allowed |

Select ‘Yes’ to allow access to this field or ‘No’ to deny access to this field. |

System Defined |

Select ‘Yes’, if the field user access definition is system defined. Select ‘No’, if the field user access definition is manually defined. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

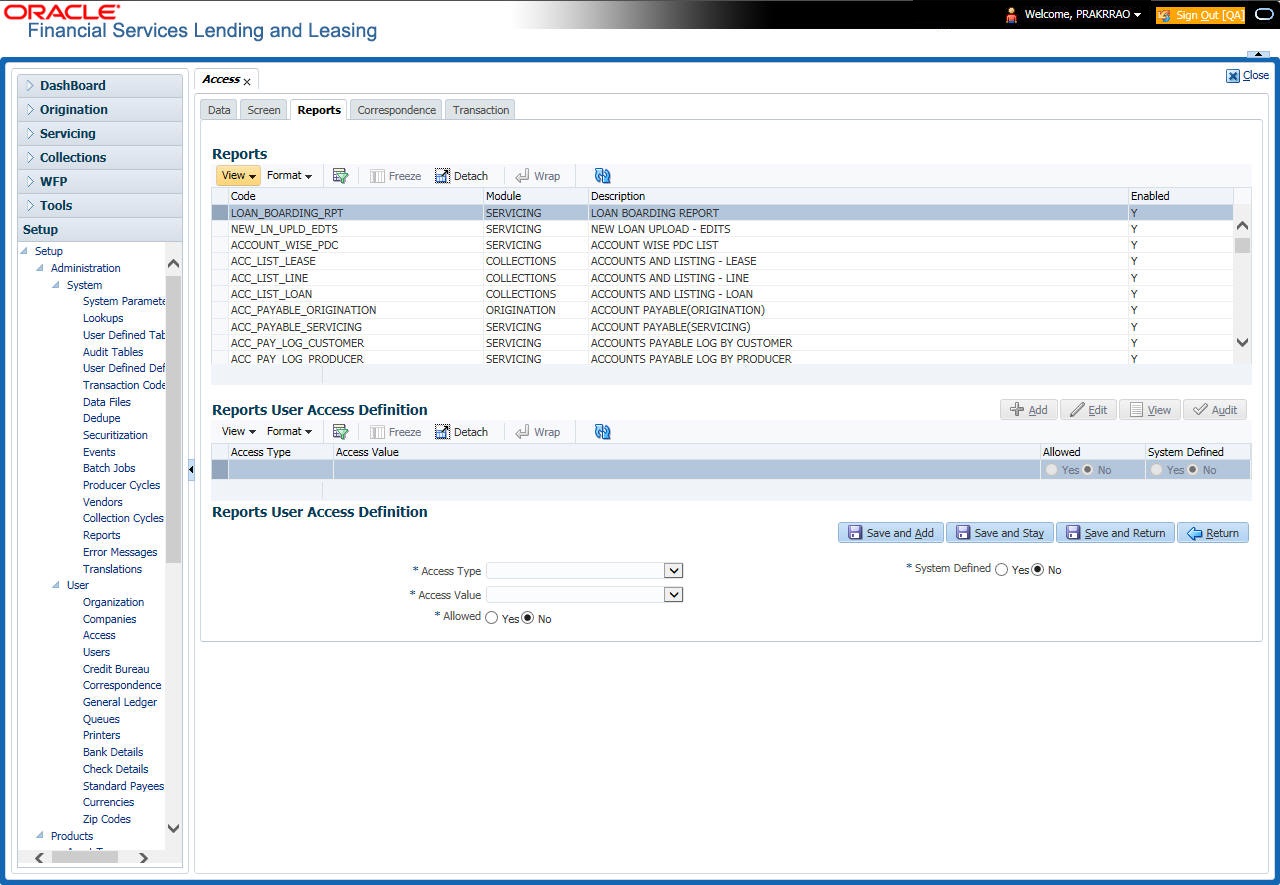

3.3.3 Reports

In the Reports screen you can control access to generate certain reports.

To set up Reports

- Click Setup > Setup > Administration > User > Access > Reports.

- In the Reports section, you can view the following information:

A brief description of the fields is given below:

Field |

View this: |

Code |

Displays the code of the report. |

Module |

Displays the code of the report from the drop-down list. |

Description |

Displays the description of the report. |

Enabled |

Displays whether the report definition is enabled or not. |

- In the Reports User Access Definition section, you can set the access rights for the report selected in the Reports section. Perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Access Type |

Select the access grid function type from the drop-down list. |

Access Value |

Select the access function grid value from the drop-down list. |

Allowed |

Select ‘Yes’ to allow access or ‘No’ to restrict access to the entry based on the access type and value. |

System Defined Yes/No |

Select ‘Yes’, if the report user access definition entry is system defined. Select ‘No’, If the report user access definition entry is manually defined. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

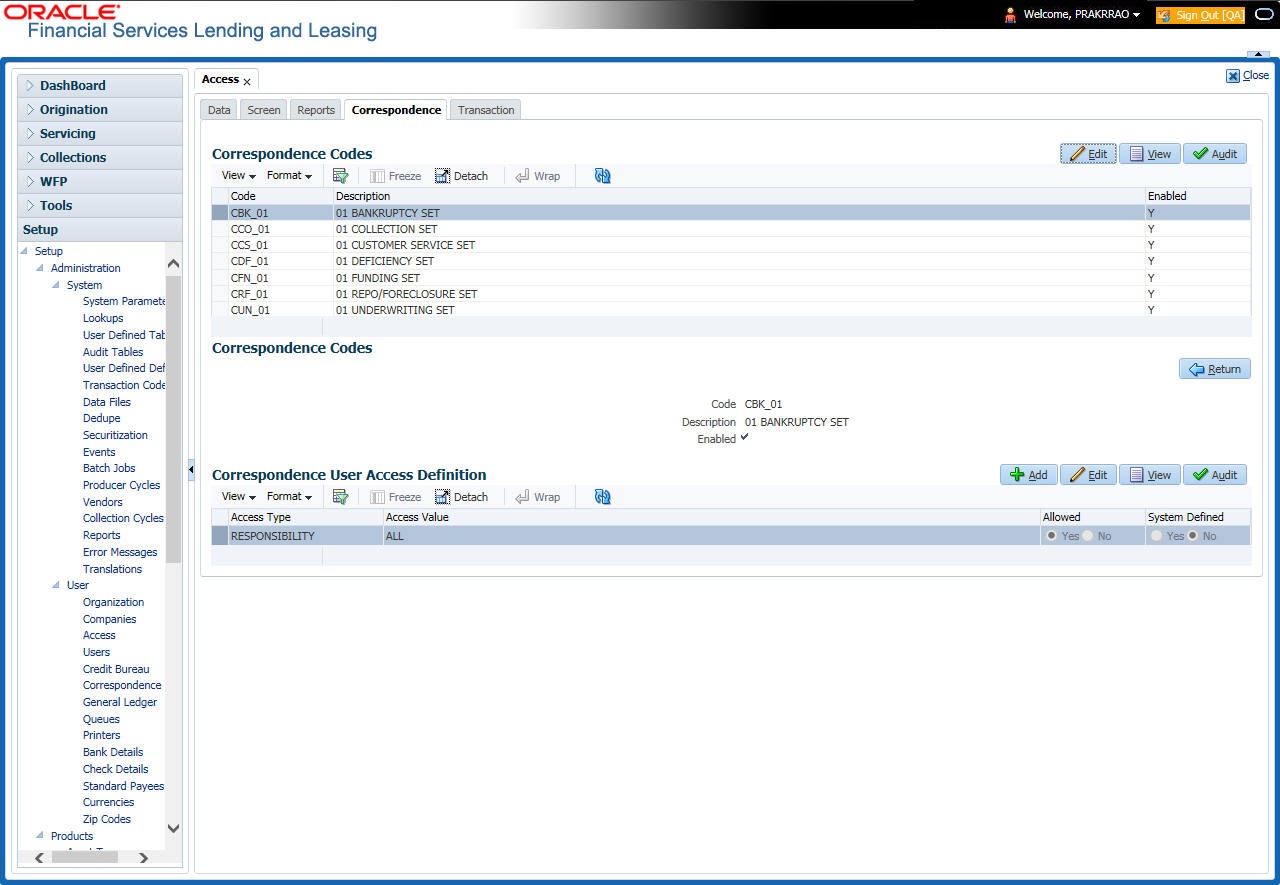

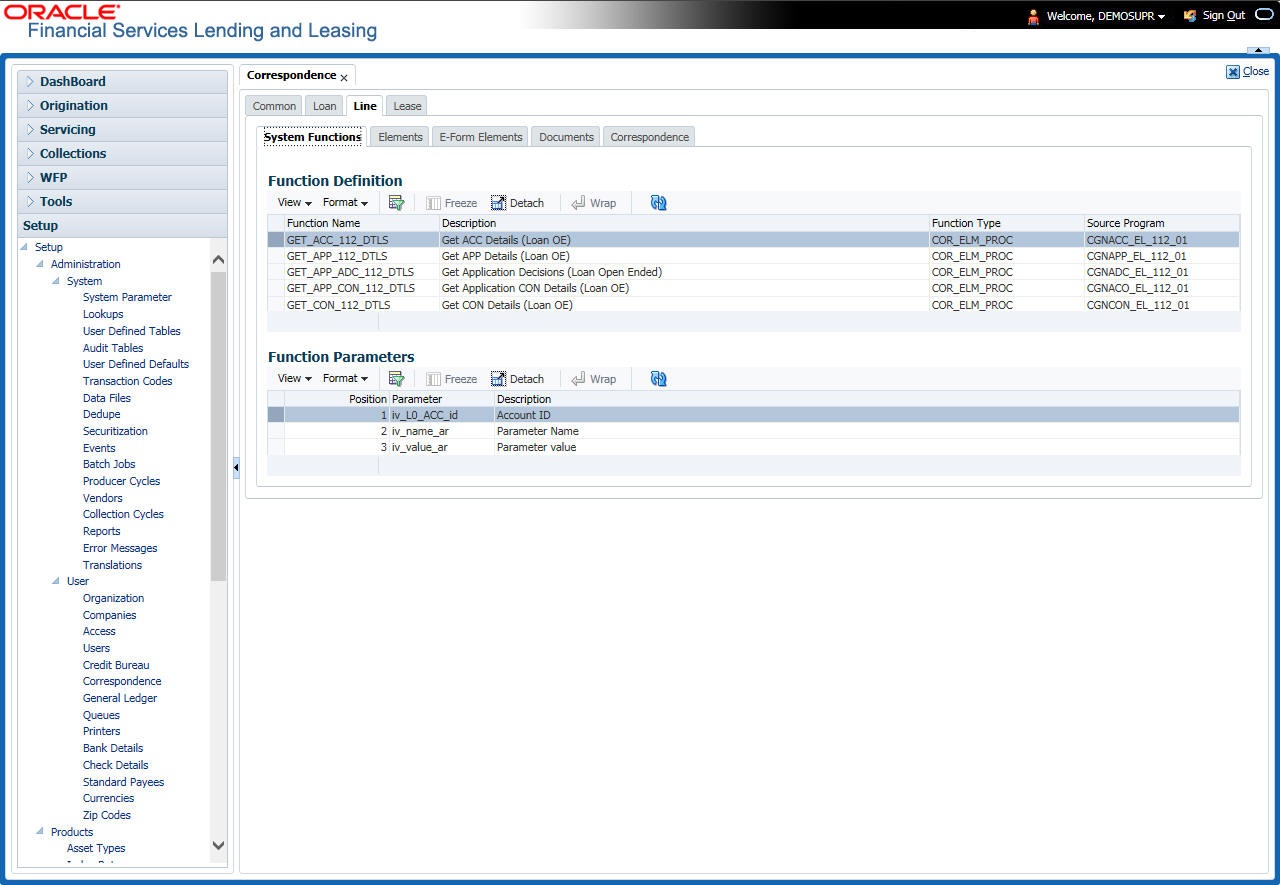

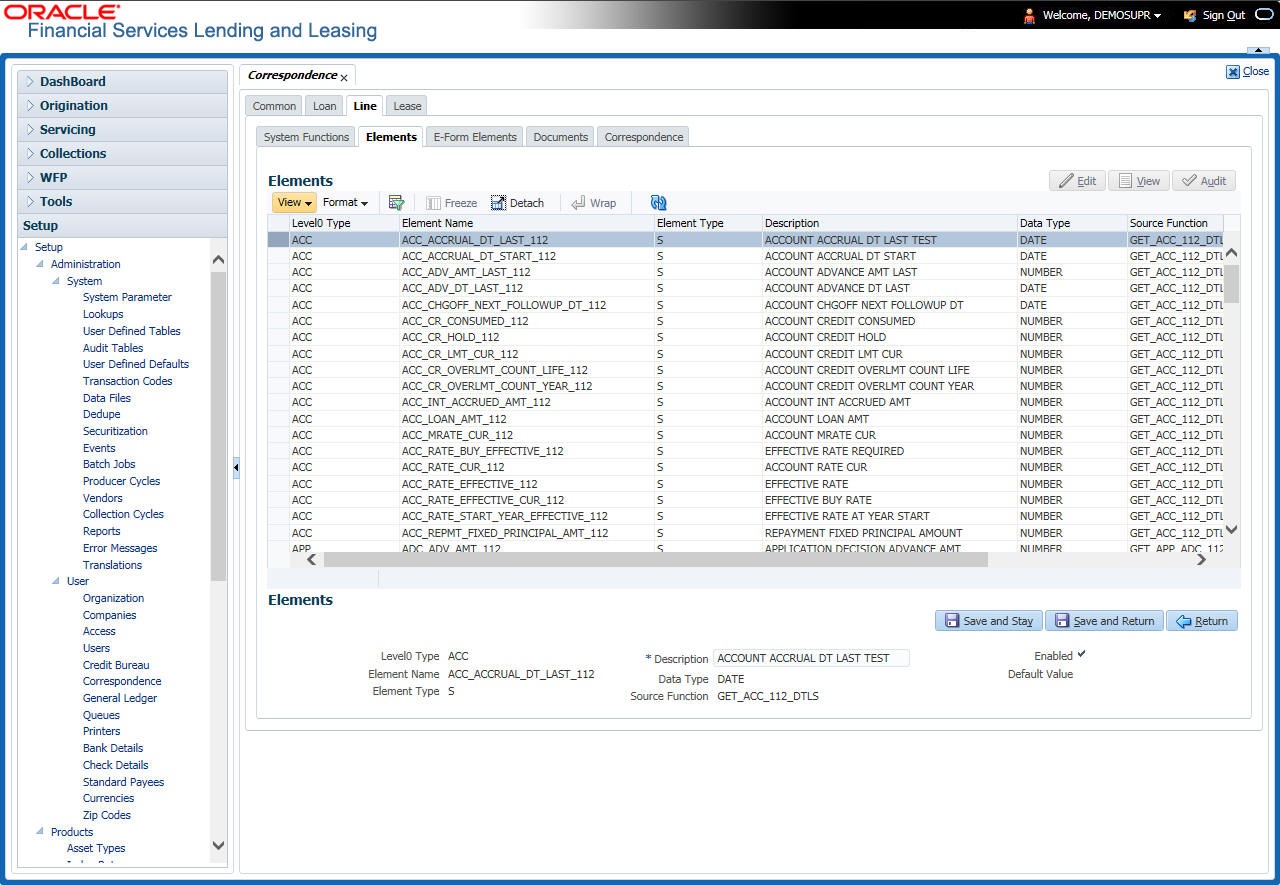

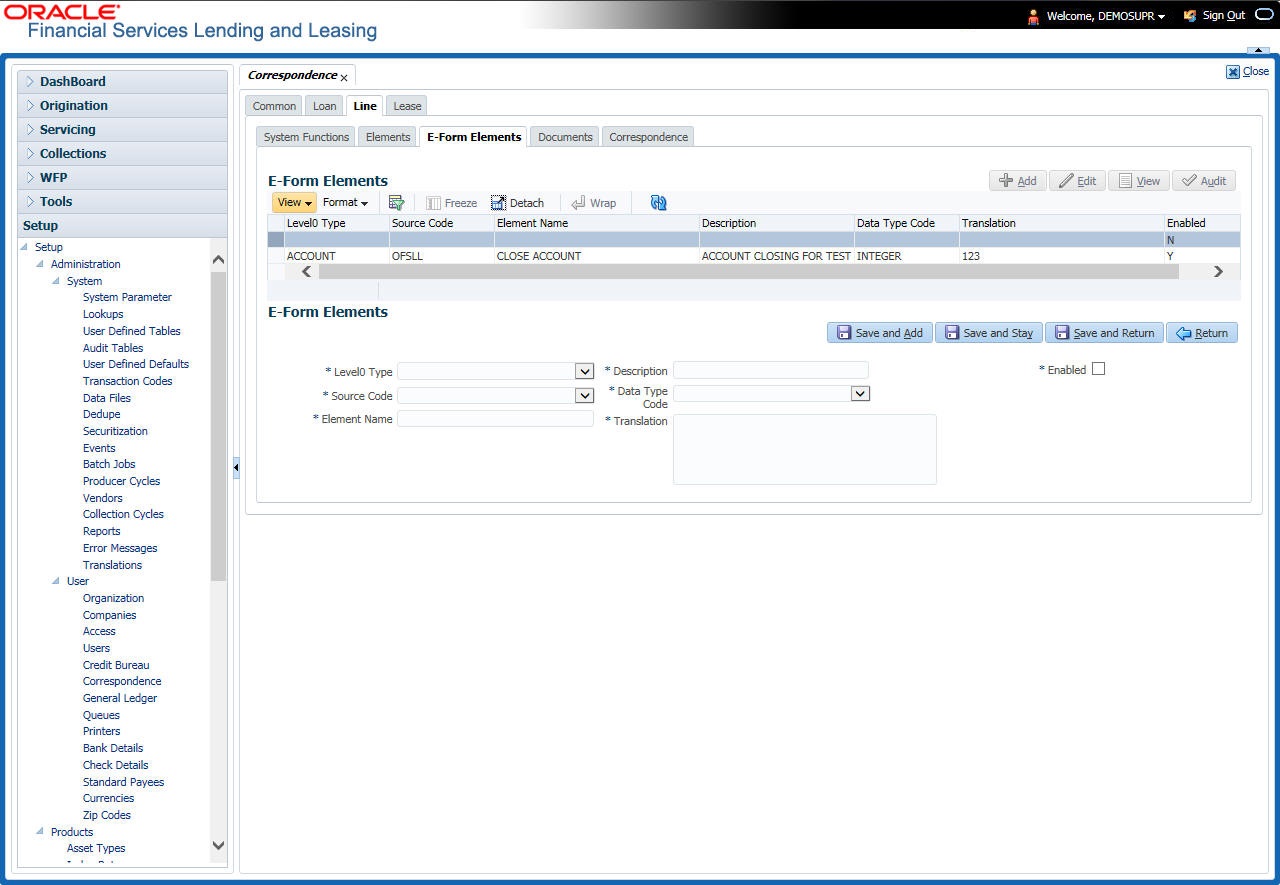

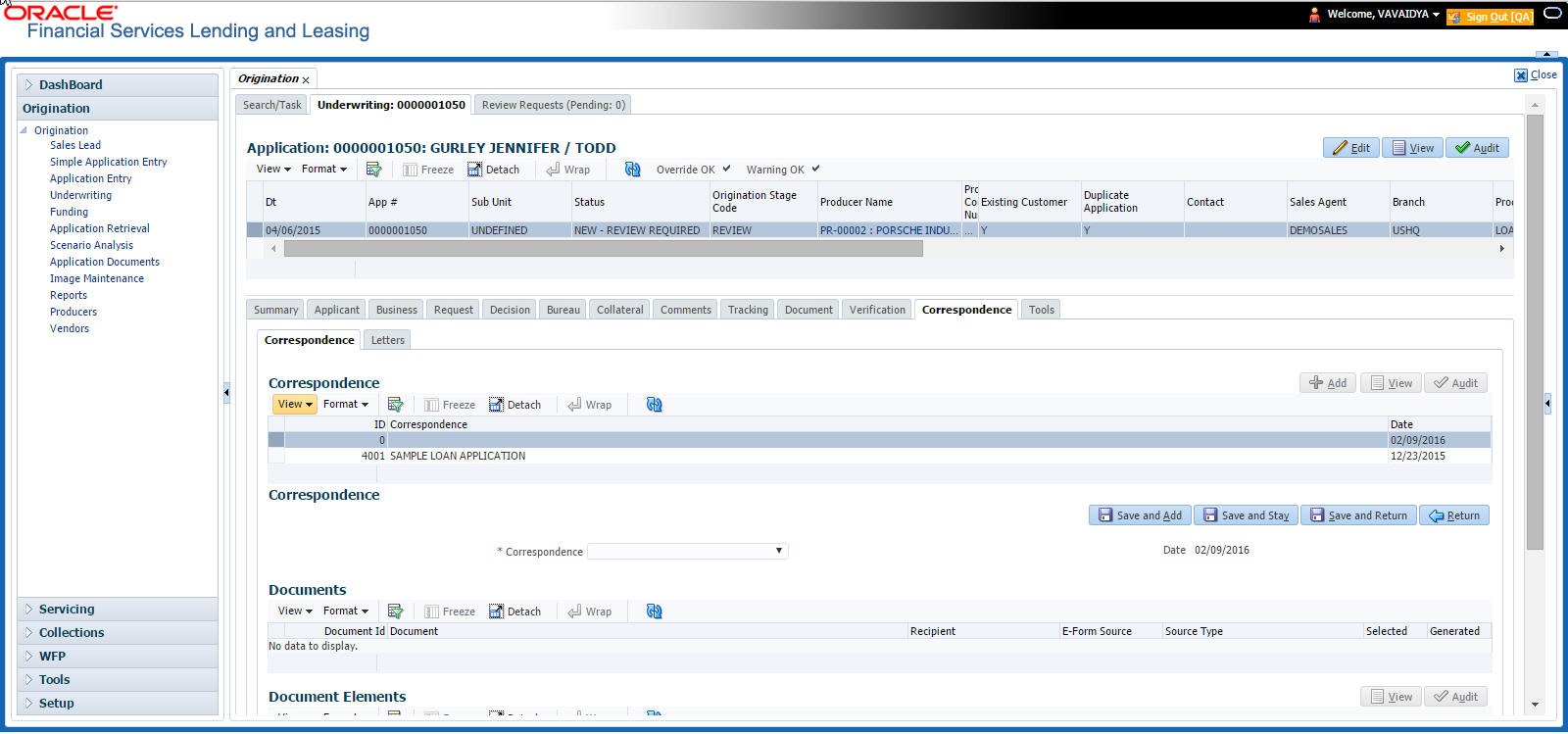

3.3.4 Correspondence

The Correspondence screen allows you to restrict access to different correspondence commands on the Letters menu, thus restricting your ability to generate certain correspondence.

If you do not have the responsibility to create a type of correspondence, the corresponding command on the Letters menu is unavailable (dimmed).

To setup the Correspondence

- Click Setup > Setup > Administration > User > Access > Correspondence.

- In the Correspondence Codes section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Code |

The system displays the correspondence code name you want to work with. |

Description |

The system displays the description for the correspondence code (display only). |

Enabled |

Check this box to enable the selected correspondence code entry. |

- In the Correspondence User Access Definition section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Access Type |

Select the access grid function type from the drop-down list. |

Access Value |

Select the access function grid value from the drop-down list. |

Allowed |

Select ‘Yes’ to allow access or ‘No’ to restrict access to the entry based on the access type and value. |

System Defined Yes/No |

Select ‘Yes’, if the correspondence user access definition entry is system defined. Select ‘No’, If the correspondence user access definition entry is manually defined. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

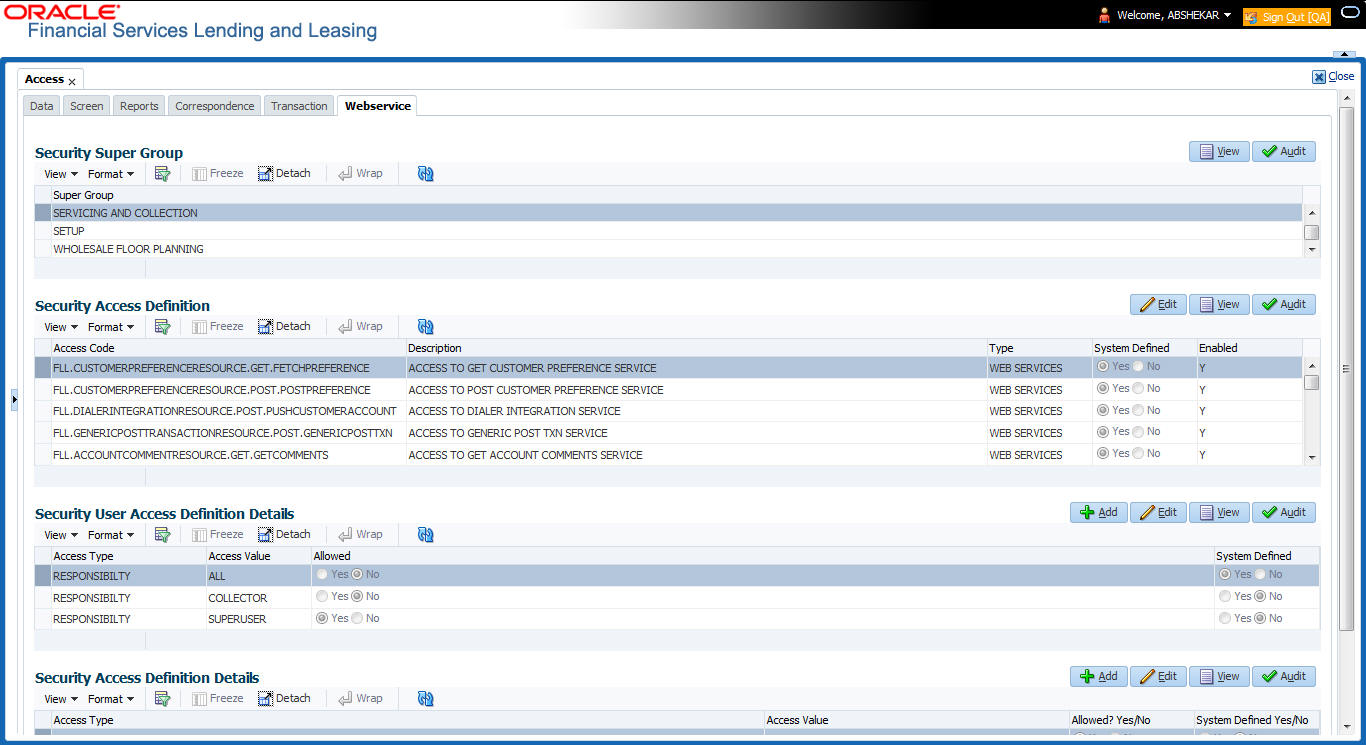

3.3.5 Webservice

The Webservice screen in Access setup allows you to configure access to the available RESTful webservices in the system. The associated seed data for all the RESTful webservices are loaded during product installation and process of installing the same is detailed in the Installation guide.

As an administrator/superuser, you can Enable/Disable Web Service access to users based on their responsibility and ensure that only authorized user have access to specific type of data in the system. Following list indicates some of the available RESTful webservices in the system and the complete list is made available in swagger JSON file shared in OTN library:

- Generic Post Transaction Service

- Call Activity Service

- Scheduler Service

- Account Search Service

- Account Boarding Service

- Payment Posting Service

- Account Detail Service

- Calculator Service

- Application Search Service

- Get Scenario Analysis Service

- Post Scenario Analysis Service

- Lookup Service

- Dialer Integration Service

- Application GET Service

- Application Entry service

- Application Update Service

- Application Status Change

- Application Checklist

- Application ACH GET Service

- Application ACH POST Service

- Application Comment GET Service

- Application Comment POST Service

- Application Document GET Service

- Application Document POST Service

- Account Comment GET Service

- Account Comment POST Service

- Account Document GET Service

- Account Document POST Service

- Process File Upload Service

- Process File Download Service

- Process File List Service

- Product Service

- Asset Service

- Asset Sub-Type Service

- Scheduler Force ReSubmit

- Remarketing GET Service

- Remarketing POST Service

- Invoice GET Service

- Invoice POST Service

To setup the Webservice access

- Click Setup > Setup > Administration > User > Access > Webservice. The screen consists of the following tabs:

- Security Super Group

- Security Access Definition

- Security User Access Definition Details

- Security Access Definition Details (This sub tab is available only for ‘SERVICING AND COLLECTION’ Super Group.

- The ‘Security Super Group’ section, contains the following super group categories for selection:

- COMMOM

- INTERFACES

- ORIGINATION

- SERVICING and COLLECTIONS

- SETUP

- WHOLESALE FLOOR PLANNING

- Select the required Super Group and the associated data in sub tabs are categorized accordingly.

- In the ‘Security Access Definition’ section, you can view the following field details and edit only the ‘Description’ and ‘Enabled’ status of selected Security Access Definition.

Field:

Do this:

Access Code

The system displays the webservice access code.

Description

The system displays the description of the associated webservice access code and can be edited for required changes.

Type

The system displays the type of security access definition.

System Defined

If selected as ‘Yes’, the security access definition entry is system defined. If selected as ‘No’, the security access definition entry is manually defined.

Enabled

Check this box to enable the selected webservice access code.

- Perform any of the Basic Actions mentioned in Navigation chapter.

- In the Security User Access Details section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields are given below:

Field: |

Do this: |

Access Type |

Select ‘Responsibility’ (default) as the access type from the drop-down list. For this access type to be available in the drop-down list, ensure that the Lookup Type ‘ACCESS_GRID_TYPE_CD’ is maintained in the system. |

Access Value |

This field is ‘Read-only’ for ‘System Defined’ Security Access Definitions which are loaded as part of seed data during installation. For non-system defined Security Access Definitions, select the access value which is the user responsibility who needs to have access to this webservice from the drop-down list. For user responsibilities to be populated in the drop-down list, ensure that the Lookup Type ‘RESPONSIBILITY_CD’ is maintained in the system. |

Allowed |

Select ‘Yes’ to allow user access to this webservice or ‘No’ to deny access. By default, No’ is selected. |

System Defined |

Select ‘Yes’, if the webservice user access definition entry is system defined. Select ‘No’, if the webservice user access definition entry is manually defined. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

Security Access Definition Details

If you have selected the Security Super Group as ‘SERVICING and COLLECTIONS’, there is an additional sub section ‘Security Access Definition Details’ enabled. This sub tab facilitates you to further restrict and control access to specific type of data within the accessible RESTful web services. The restriction can be defined based on specific ‘Account Condition’ or ‘Account Status’.

For example, out of all the account types maintained in the system you can restrict data access to only delinquent account(s) to a particular user responsibility by selecting Access Type as ‘Account Condition’ and Access Value as ‘Delinquent’,

Controlling web service data access to permitted user(s)

For any user to access web service data, you need to define atleast one positive (allowed) definition defined in 'Security Access Definition Details' section. Else, webserivce data is not displayed for that particular user even if that user responsibility has permissions to access web service.

OFSLL supports multiple user conditions on an Account and system requires to have atleast one account condition defined as ‘Allowed’ in setup to display the data. In case, even if any one of the account condition is defined as ‘Not Allowed’ in setup, then system does not allow to access the data.

During the following scenarios, data is either displayed/not displayed in Webservice screen:

Scenario |

Data displayed |

No condition is available on the account and also no condition defined in setup |

Data is displayed since there is no restriction. |

Condition is available on the account but not defined in setup |

Data is not displayed since restriction is applied |

Multiple conditions are available on the account and one condition is defined in setup as ‘Allowed’ |

Data is displayed |

Multiple conditions are available on the account and one condition is defined in setup as ‘Not Allowed’ |

Data is not displayed |

Whenever user with specific responsibility tries to access the restricted data, following type of error messages are displayed:

- For POST/PUT service, system displays error as ‘Access denied’ with HTTP Error Code 401.

- For GET service with single account record, system displays error message as ‘No data found’ with http error code 400.

- For GET service with multiple account records, of which some have access restriction and other don’t, then system displays only the unrestricted records and does not display the restricted records. In such a case, error message is not displayed.

Note

When multiple user access definitions are defined in the system, while processing the data access request to a web service OFSLL first validates for any access restrictions on the user responsibility. If not, then validates the same against 'ALL' responsibility before displaying the data in Webservice screen.

For example, if data access restriction is defined for ALL and SUPERUSER responsibilities. when logged in with SUPERUSER responsibility, the data restriction of SUPERUSER is applied. In case, if the user logs in with any other responsibility other than SUPERUSER, then restriction defined for ‘ALL’ is applied.

To define Security Access Definition Details

- Click Setup > Setup > Administration > User > Access > Webservice tab.

- Select the module in Security Super section as ‘SERVICING and COLLECTIONS’.

- Select the user responsibility in ‘Security User Access Definition Details’ section.

- In the Security Access Definition Details section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields are given below:

Field |

Do this: |

Access Type |

Select the access function type (as either ACCOUNT CONDITION or ACCOUNT STATUS) that is being used to control the user access from the drop-down list. |

Access Value |

Select the access value from the drop-down list. The list is sorted based on the Access Type selected. Also, based on a lookup associated with the Access Type multiple entries for each access type can be created as long as each has a different access value. |

Allowed? Yes/No |

Select ‘Yes’ if the access is allowed and ‘No’ if the access is not allowed. This indicates whether the selected combination of Access Type and Access Value is allowed to access the data. |

System Defined Yes/No |

Select ‘Yes’, if you wish to maintain access type as system defined and ‘No’, if you do not want to maintain it as system defined. However, system defined entries cannot be modified. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

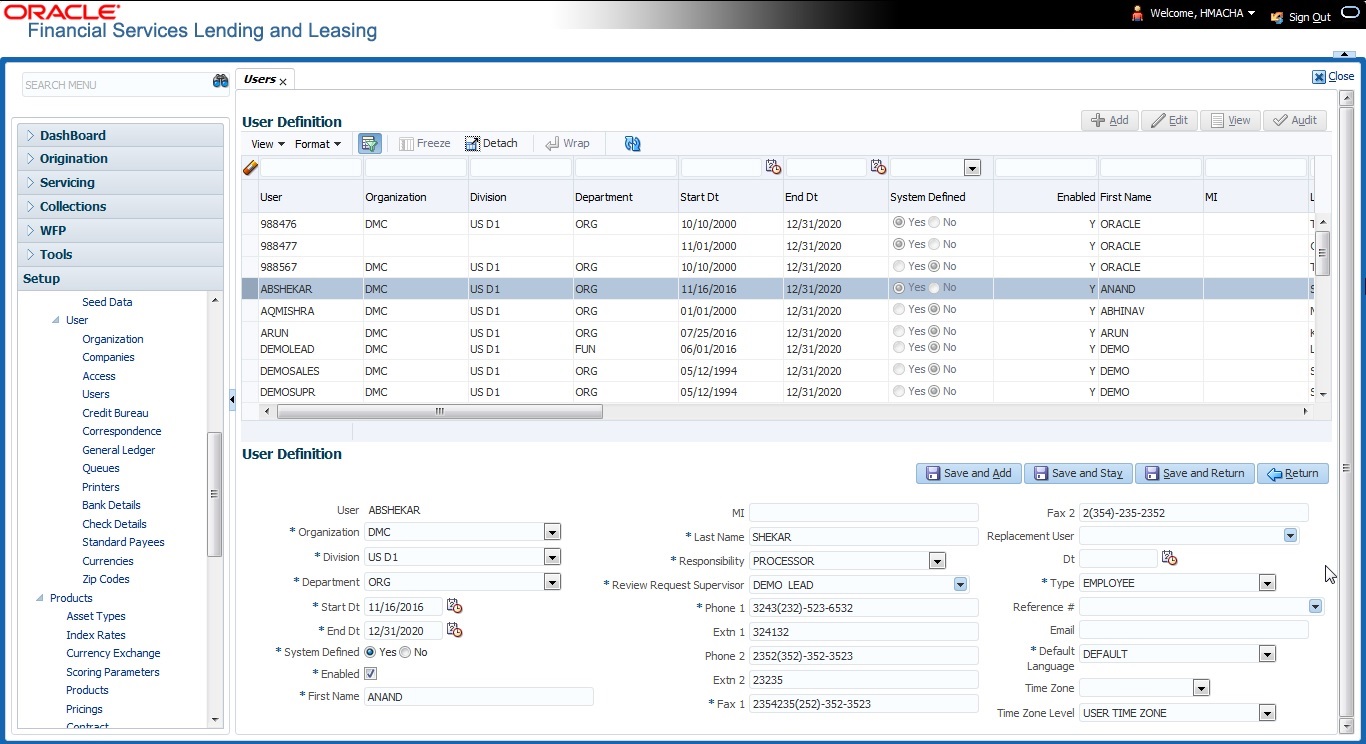

3.4 Users

The Users screen allows you to create and set up an user. In the User Definition section, you can assign a user an identification name and password to log on to the system. You can also assign the organization, division, and department where each user is located. Additional fields allow you to record information for contacting the user. You can also define the time frame within which a user has access to the system to ensure compliance to the company’s schedule. This is a very useful feature to prevent logins during scheduled maintenance.

The Responsibility field records the job function of the user and defines the level of access that user has within the system; in particular:

- What menu items does the user have access to?

- What edits can the user perform on the Verification link during origination?

Note

The system’s SUPERUSER responsibility grants access to the entire system. Give careful consideration to the number and type of users who receive this responsibility.

To set up the Users screen

- Click Setup > Setup > Administration > User > Users. The system displays the Users screen.

- In the User Definition section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

User |

Specify the user ID. Note: This field is a unique indicator and cannot be updated, edited, or deleted once saved. |

Organization |

Select the organization to which the user belongs, from the drop-down list. |

Division |

Select the division to which the user belongs, from the drop-down list. |

Department |

Select the department to which the user belongs, from the drop-down list. |

Start Dt |

Specify the start date for the user. You can also select from the adjoining calender icon. |

End Dt |

Specify the end date for the user. You can also select from the adjoining calender icon. |

System Defined |

Select ‘Yes’, if the entry is system defined. System defined entries cannot be modified. Select ‘No’, if the entry is not system defined and it can be modified. |

Enabled |

Check this box to enable the user. |

First Name |

Specify the first name of the user. |

MI |

Specify the middle initial of the user. |

Last Name |

Specify the last name of the user. |

Responsibility |

Select the responsibility for the user from the drop-down list. Note: The users mapped to the role ‘Responsibility’ can only view the screens. |

Review Request Supervisor |

Select the supervisor responsibility who can also review and respond to review requests from the drop-down list. The list displays the corresponding Review Request Supervisors who are either one or more levels higher from the above selected user ‘Responsibility’ as maintained in ‘RESPONSIBILITY_CD’ lookup code. |

Phone 1 |

Specify the user’s primary phone number. |

Extn 1 |

Specify the phone extension for the primary phone number. |

Phone 2 |

Specify the user’s alternate phone number. |

Extn 2 |

Specify the phone extension for the alternate phone number. |

Fax 1 |

Specify the user’s primary fax number. |

Fax 2 |

Specify the user’s alternate fax number. |

Replacement User |

Select the user ID of the replacement user from the drop-down list. |

Dt |

Specify the date from when the replacement is effective. You can also select from the adjoining calender icon. Note: These two fields allow you to create a replacement user for the current user. This is particularly useful when a new employee assumes the duties of a former. By completing the Replacement User and Replacement Dt field, the system recognizes the replacement user as the current user on the effective date. For more information, refer the section, ‘Replacement Users’. |

Type |

Select the user type from the drop-down list. |

Reference # |

Specify the reference number for the user from the drop-down list. |

Specify user’s email address. |

|

Default language |

Select the default language from the drop-down list. |

Time Zone |

Select the required Time Zone from the drop-down list, The specified time zone would be applicable at company level. |

Time Zone Level |

Select the time zone level (Organization, Company or User) that would apply by default, when specific time zone is not specified at Company and User level. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

3.4.1 Replacement users

By completing the Replacement User and Dt fields on the Users screen, you can replace an existing user with a new user. The system assigns all responsibilities of the original user to the new user as of the date of the replacement.

The Replacement User and Dt fields allow you to designate a replacement for the current user in the User ID field. When you complete the Replacement User and Dt fields, save your entry, and then enable the record, the system replaces the original user. The system changes the End Dt field to the date when the original user was replaced (the same date in the Dt field).

The system assigns the queues of the original user to only those replacement users who have the same user responsibilities (or Super User responsibility) as set in the system.

The system updates the following when replacing users:

- Assigns all applications in the replaced user’s underwriting queue with the status New to the replacement user’s queue.

- Assigns all applications in the replaced user’s funding queue with a status other than Funded to the replacement user’s queue. The system currently stores the collector name in the back end tables, which are updated with the replacement users ID in the case of the replacement of any user.

- Also updates the Producer Management screen with the replacement user in the Underwriter and Collector fields. The system assigns all applications routed to the original user to the replacement user. This also includes any future applications for the replaced user.

- The system automatically updates the Collector ID field in all accounts to the replacement user and routes all accounts assigned to the original user to the replacement user.

Note

The system will not update the replacement user ID for accounts that are closed.

- On the queue setup of Customer Service screen’s Responsibilities sub screen, the record for the original user will be disabled and a new record will be created for the replacement user. If the replacement user already exists in the setup, The system will not create a new record. It updates the user ID and routes all accounts that were assigned to the original user, based on the account condition, to the replacement user.

3.4.2 Application and Oracle Identity Manager Synchronization

Oracle Identity Manager is for user administration. Oracle Financial Services Lending and Leasing has been developed in such a way that it can be implemented with or without Oracle Identity Manager. In case OID has been employed, the user definition is done in OID and then synchronized to the Oracle Financial Services Lending and Leasing Users table using a utility JAR called OID Synchronization JAR. In OID, users are defined across various groups belonging to a realm which is nothing but the directory structure in OID. A user can be configured to belong to multiple groups in a realm. Every time the user tries to login to Oracle Financial Services Lending and Leasing or OBIEE, the system validates the login ID and the password with OID and provides access to those applications.

3.5 Credit Bureau

In the system, an important part of the origination process is pulling a credit report from a credit bureau and scoring that information against a user-defined risk model. These credit reports can be pulled both automatically and manually.

After you enter an application, the system compares its contents against pre-screen criteria. If the application passes a pre-screen edits check, the system advances the status of the application and automatically pulls a credit report.

You can manually request a credit report for an applicant or any other party included on the application, such as co-signers and spouses by selecting the bureau from which you want to pull the report. If more than one report type is defined for the selected bureau, then you can indicate the type of report you want to pull.

The following are few additional Credit Bureau Setup details:

- The credit bureau from which the report is pulled is determined by the applicant’s zip code. The credit bureau interface searches the information in the Credit Bureau Zip Matrix tab and matches the applicant’s zip code to determine the bureau(s) from which to request a report.

- The number of credit reports automatically pulled per applicant is controlled through the credit request parameter CRB_MAX_BUREAU_PULL. If this parameter is set to 1, a credit bureau request will be made for the Bureau1 credit bureau from the zip code matrix. Likewise, if this parameter is set to 2, a credit bureau request will be made for the Bureau1 and the Bureau2 credit bureaus from the zip code matrix.

- The system automatically pulls credit reports for only the primary applicant and the primary applicant's spouse (for joint applications) unless the CRB_ALL_APL_BUREAU_PULL credit request parameter is set to Y. However, if the parameter is set to Y, the system pulls credit reports for all of the applicants on the Line of credit, regardless of their relationship to the primary borrower.

- Passwords, default report formats, and other required information from the credit bureaus are set up in the Report Formats screen.

- For identity scan data to flow into Equifax ACRO/ACRO Plus credit reports, the add-on has to be enabled at contract level. Please speak to your representative for enabling the add-on.

Member codes and passwords when switching credit bureau access methods (moving from dial-up to Net Connect). The member codes and passwords are not dependent on the connection method used to access the bureau.

Frame relay access is from the database server to the Experian host though a TCP/IP socket connection. The connection is outbound only and it is to a specific port (699 or 700) on the Experian host.

The credit bureau service will be accessing Experian Net Connect service through HTTP to the ECALS URL supplied by Experian as well as by the HTTPS to the URL returned as a response to the ECALS URL inquiry (the credit request URL). This access is from the database server access.

3.5.1 Credit Bureau

The setup for Credit Bureau spans across the following links:

- Report Formats

- Connections

- Zip Matrix

- Parameters

- Score Reasons

- Reporting

Navigating to Credit Bureau

- On the Oracle Financial Services Lending and Leasing home screen, click Setup > Setup > Administration > User > Credit Bureau.

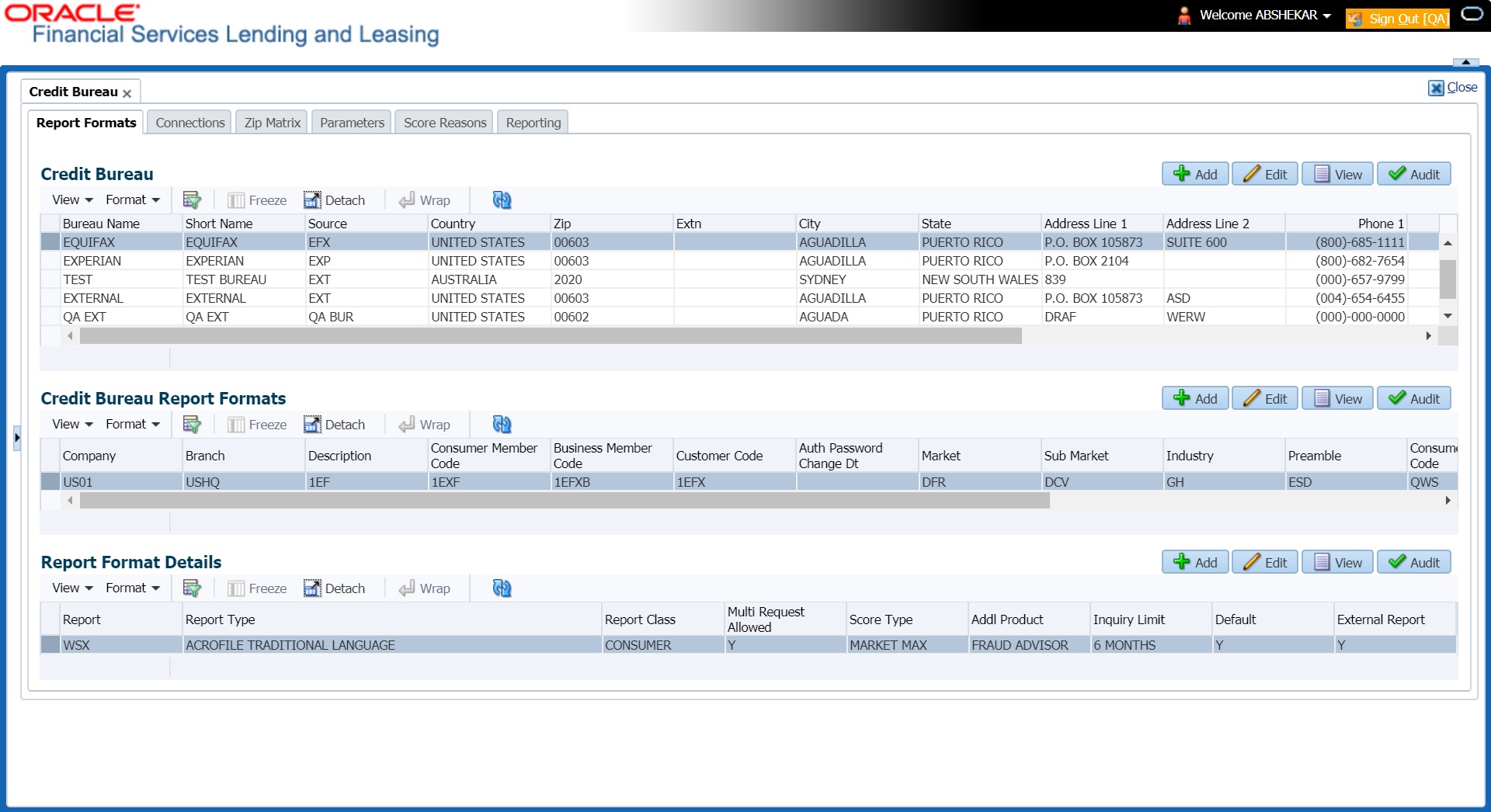

3.5.1.1 Report Formats

The Reports Formats screen captures and tracks the attributes related to the multiple types of reports offered by the credit bureau agencies. When a company enlists the service of a credit bureau, the credit bureau provides a membership code and password. This information needs to be entered on the Reports Formats screen before you can request a credit report. You must define at least one report for each credit bureau from which you want to pull reports.

The information on the Report Formats screen is location-specific. If the business requires different membership codes for each location, be it a company or branch, then individual records must be set up.

The Score Type, Additional Product, and Inquiry Limit fields on the Credit Report Setup section are optional. They may not apply to all credit bureau types and even if they do apply, you may want to leave them blank and rely on a default value set up at the credit bureau.

Note

For more information, refer to the the application Installation Guides.

To setup Report Formats

- Click Setup > Setup > Administration > User > Credit Bureau > Report Formats

- In the Credit Bureau section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Bureau Name |

Specify the name of the credit bureau company. |

Short Name |

Specify the abbreviated or short name for the bureau. |

Source |

Select the credit bureau source from the drop-down list. |

Country |

Select the country of the credit bureau address from the drop-down list. |

City |

Specify the city for the credit bureau address. |

State |

Select the state of the credit bureau address from the drop-down list. |

Address Line 1 |

Specify the address line 1 for the credit bureau. |

Address Line 2 |

Specify the address line 2 for the credit bureau. |

Zip |

Select the zip code for the credit bureau address from the drop-down list. |

Extn |

Specify the extension of the zip code for the credit bureau address. |

Phone 1 |

Specify the primary phone number for the credit bureau. |

Extn 1 |

Specify the extension for the primary phone number. |

Phone 2 |

Specify the secondary phone number for the credit bureau. |

Extn 2 |

Specify the extension for the secondary phone number. |

Fax 1 |

Specify the primary fax number for the credit bureau. |

Fax 2 |

Specify the alternative fax number for the credit bureau. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

- In the Credit Bureau Report Formats section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field |

Do this: |

Company |

Select the portfolio company that will be using the above credit bureau from the drop-down list. |

Branch |

Select the portfolio branch from the company that will be using the above credit bureau from the drop-down list. |

Description |

Specify the credit report format description. |

Member Code |

Specify the credit bureau member code (assigned by bureau). |

Password |

Specify the credit bureau password. |

Customer Code |

Specify the customer code. |

Auth Password Change Dt |

Display the last authorization password change date. The Experian Net Connect product requires that the Auth Password (or SSP Password in Experian jargon) be changed every 90 days (or sooner). Equifax may have similar requirements, but they were not known at the time of this writing. Use the date displayed in this field to identify when the password needs to be changed. Note: The password needs to be changed both in the system and at the credit bureau. Changing the password does not initiate or perform a change at the bureau. Changing the password at the bureau must be done outside the system. Contact the credit bureau for the procedure for changing the password (display only). |

Auth User ID |

Displays the authorization user ID (display only). |

Auth Password |

Displays the authorization password (display only). Note: This field is not displayed to the user and is also encrypted before being stored in the database (display only). |

Change Authorization User Id/Password section |

|

New Auth User Id |

Specify the authorization user ID. |

New Auth User Password |

Specify the authorization user password. |

TransUnion Details section (Note: This is only applicable for TransUnion.) |

|

Market |

Specify the TransUnion market id. |

Sub Market |

Specify the TransUnion Sub Market id. |

Industry |

Specify the TransUnion Industry code. |

Experian Details section (Note: This is only applicable for Experian.) |

|

Preamble |

Specify the Experian preamble code. |

Host Code |

Specify the Experian host ID. |

UIC |

Specify the Experian UIC. |

Equifax Details section (Note: This is only applicable for Equifax.) |

|

Service Name |

Specify the equifax service name. The service name will be provided to you by Equifax when your company's Internet System to System account is created. Possible values for pulling credit reports are acrotest (for access to the test system) and acro (for access to the production system). |

- Perform any of the Basic Actions mentioned in Navigation chapter.

- In the Report Format Details section, you can choose the various parameters of report format and also indicate if the report is to be processed internally or externally.

To support geography specific Credit Bureau integration, external interface is also supported in OFSLL. In such case, a webhook request for Credit Bureau Onboarding report is initiated from OFSLL. The same is processed in external bureau service depending on the endpoint configuration (type of bureau to be used as defined in Setup > Administration > System > Webhook screen).

Based on the response received the ‘Credit Bureau Put’ web service is triggered to update the details. Also on processing CREDIT_REQUEST_DETAILS the ‘Status’ of the request received in CRL_CRB_REP_STATUS_CD is updated in ‘Bureau’ tab of Origination and Servicing screens in the following combination:

CRL_CRB_REP_STATUS_CD |

Bureau Details > Status |

|

Primary |

Secondary |

|

Completed |

Completed |

Completed |

Completed |

Failed |

Failed |

Failed |

Completed |

Failed |

Failed |

Failed |

Failed |

Submitted |

Completed |

Submitted |

Completed |

Submitted |

Submitted |

- Perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field |

Do this: |

Report |

Specify the report name to be accessed from the credit bureau. |

Report Type |

Select the report type of the credit bureau report from the drop-down list. |

Report Class |

Select the report class as either Consumer or Business from the drop-down list. |

Multi Request Allowed |

Check this box to allow report request from multiple bureaus. |

Score Type |

Select the credit score type from the drop-down list. |

Addl Product |

Select the product code from the drop-down list. |

Inquiry Limit |

Select the inquiry limit for the credit report from the drop-down list. |

Default |

Check this box set this as default report format. |

External Report |

Check this box if the Credit Bureau Onboarding report request format is to be processed from external system. If selected, the encoding and decoding of request details and pooling of data into report is handled externally. By default, this check box is not selected and Credit Bureau Onboarding report request is processed within the system. |

- Perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field |

Do this: |

Report |

Specify the report name to be accessed from the credit bureau. |

Report Type |

Select the report type of the credit bureau report from the drop-down list. |

Score Type |

Select the credit score type from the drop-down list. |

Addl Product |

Select the product code from the drop-down list. |

Inquiry Limit |

Select the inquiry limit for the credit report from the drop-down list. |

Enabled |

Check this box to enable the report as default. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

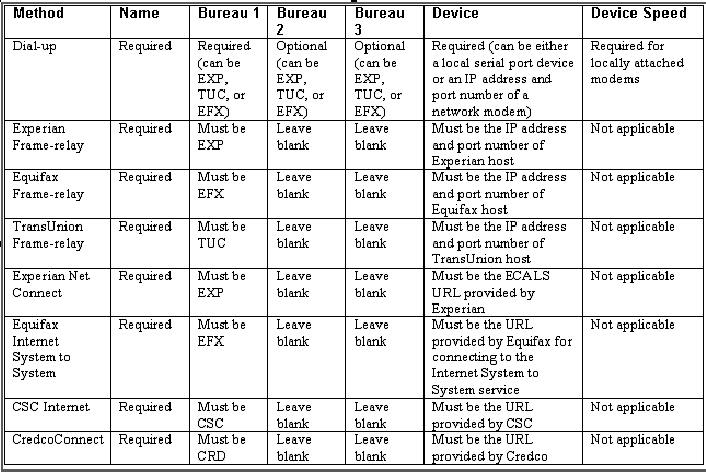

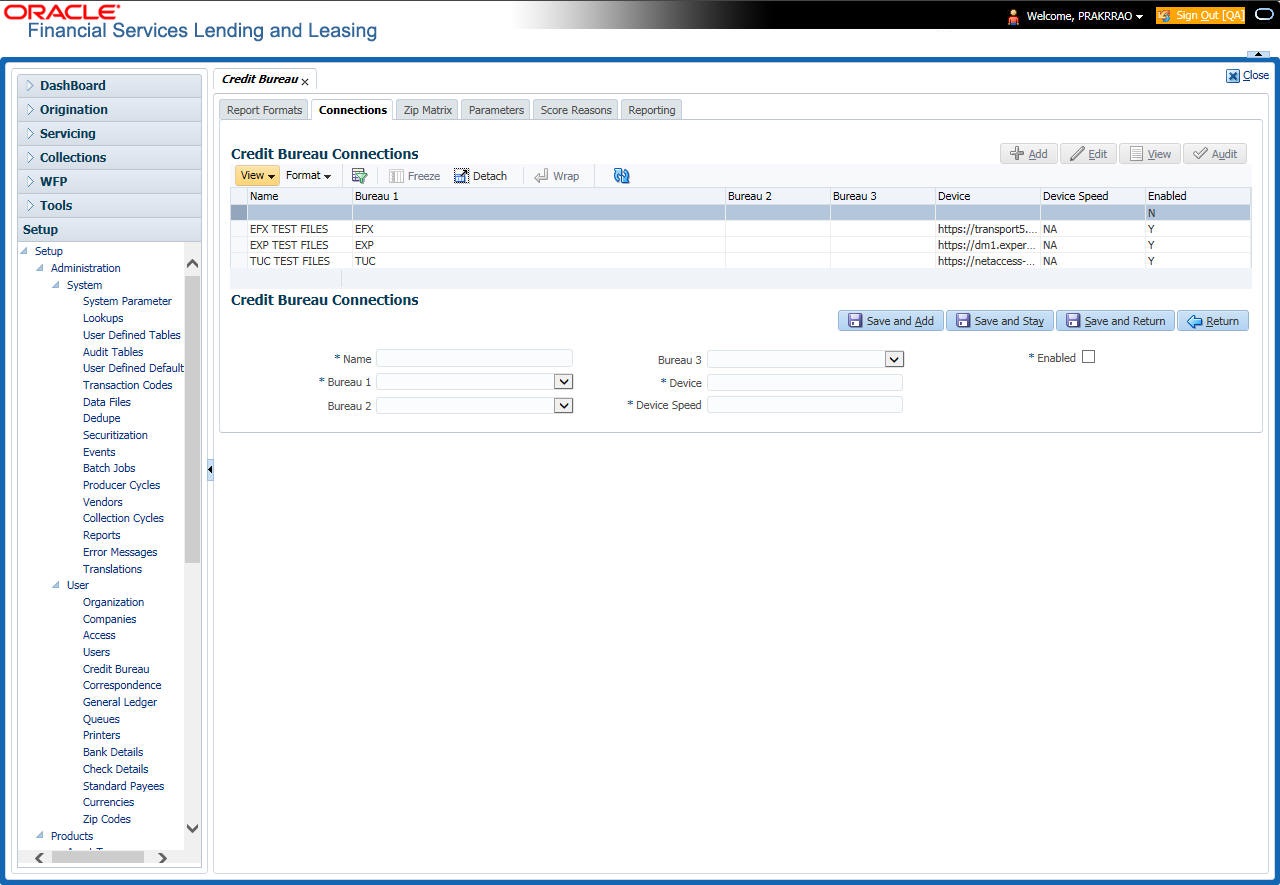

3.5.1.2 Connections

The Connections screen records and supports various connections to the credit bureau to receive reports from the agencies. The system supports connections to the bureaus through one or more modems attached to the database server, network accessed modem server, or direct network connection (usually frame relay).

For modem-based connections, multiple credit bureaus can be accessed over the same modem. If there are multiple requests in the queue, the order in which the bureaus are listed determines the order in which the requests are processed.

For example,

If the credit bureau service checks the submitted credit requests and finds three Experian, one Equifax, and two TransUnion credit requests and the connections setup is Bureau1=TUC, Bureau2=EFX, and Bureau3=EXP, the two TransUnion requests will be processed first, the Equifax request next, and then the three Experian requests.

Note

For this above example, adding two more modems and assigning a specific bureau to each one would help to avoid the delay caused by queuing all requests through a single modem.

IMPORTANT: Direct network connections must be set up for only one bureau.

Like the Credit Bureau section on the Report Formats screen, the data fields used on the Connections screen are generic and not all fields are used for all access methods. The following table summarizes the data needed for each access method:

For frame relay access, specify the IP address provided by the bureau followed by a space and then the port number (for example, 192.168.36.2.700).

Experian Net Connect

At the time of this writing, the Experian product ECALS URL is:

http://www.experian.com/lookupServlet1?lookupService

Name=AccessPoint&lookupServiceVersion=1.0&serviceName=Net

Connect&serviceVersion=2.0&responseType=text/plain

Note

The URL given above is one continuous string. This can be verified by entering the URL with a browser. The displayed value will be an HTTPS URL.

Enter the entire ECALS URL provided by Experian into the Device field. Notice that this URL does not start with https. The ECALS URL is a URL used by the credit bureau service to request the HTTPS URL. The HTTPS URL is not displayed on any setup screen and is only known to the credit bureau interface at runtime.

Equifax Internet System to System

At the time of this writing, the Equifax Internet System to System URL is:

https://transport5.ec.equifax.com/servlet/stspost

CSC Tri-Merge

At the time of this writing, the CSC URL is:

https://www.emortgage.Equifax.com/cgi-bin/emspop.exe

To setup the Connections

- Click Setup > Setup > Administration > User > Credit Bureau > Connections.

- In the Credit Bureau Connections section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Name |

Specify connection name. |

Bureau 1 |

Select first credit bureau from the drop-down list. |

Bureau 2 |

Select 2nd credit bureau from the drop-down list. |

Bureau 3 |

Select 3rd credit bureau from the drop-down list. Note: The Bureau1, Bureau2, and Bureau3 fields in the Credit Bureau Connections section specify which bureau types can be accessed over the connection. |

Device |

Specify the connection device name. The Device field lists the physical device name for a modem, or the IP address for a network accessed connection. |

Device Speed |

Select the connection device speed. The Device Speed field is only applicable to server-attached modems. It is used to specify the communications speed between the server and the modem. |

Enabled |

Check this box to enable the connection. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

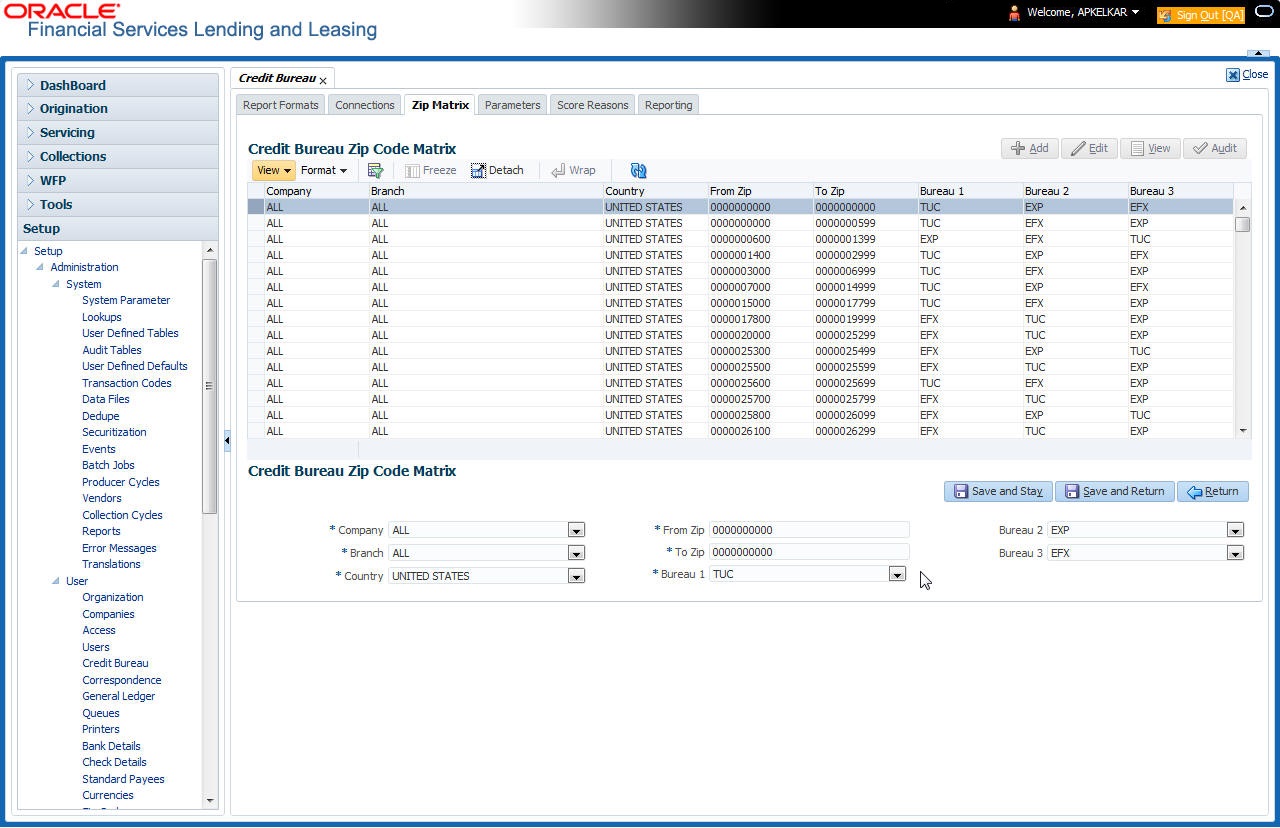

3.5.1.3 Zip Matrix

The system uses the zip code of the applicant’s current home address to determine which credit bureau to use when automatically pulling a report. The Zip Matrix screen allows you to record the credit bureau from which a report is pulled based on a range of zip codes, as well as the company, branch and country of the account.

When searching for a zip code match, the system:

- Reads the first credit bureau defined in the matrix

- Reads the credit report format to get the appropriate membership code and password for the user’s location

- Requests a credit report.

If the system cannot pull a report from the first bureau, it pulls one from the second. If the zip code you entered does not fall in the matrix setup, then the system uses a default zip matrix (0000000000 to 0000000000) to select the required bureau.

To set up the Zip Matrix

- Click Setup > Setup > Administration > User > Credit Bureau > Zip Matrix

- In the Credit Bureau Zip Code Matrix section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Company |

Select the portfolio company from the drop-down list. |

Branch |

Select the portfolio branch from the drop-down list. The branch will be displayed based on the company selected. |

Country |

Select the country from the drop-down list. |

From Zip |

Specify the starting zip code (From). |

To Zip |

Specify the ending zip code (To). |

Bureau 1 |

Select the preferred bureau #1 (first bureau pulled), from the drop-down list. You must enter at least one credit bureau in the Bureau 1 field for each zip code range. The bureau entered in the Bureau 1 field for each range is the primary bureau. For any given range, do not list the same credit bureau in more than one field. |

Bureau 2 |

Select the preferred bureau #2 (second bureau pulled) from the drop-down list. |

Bureau 3 |

Select the preferred bureau 3 (third bureau pulled) from the drop-down list. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

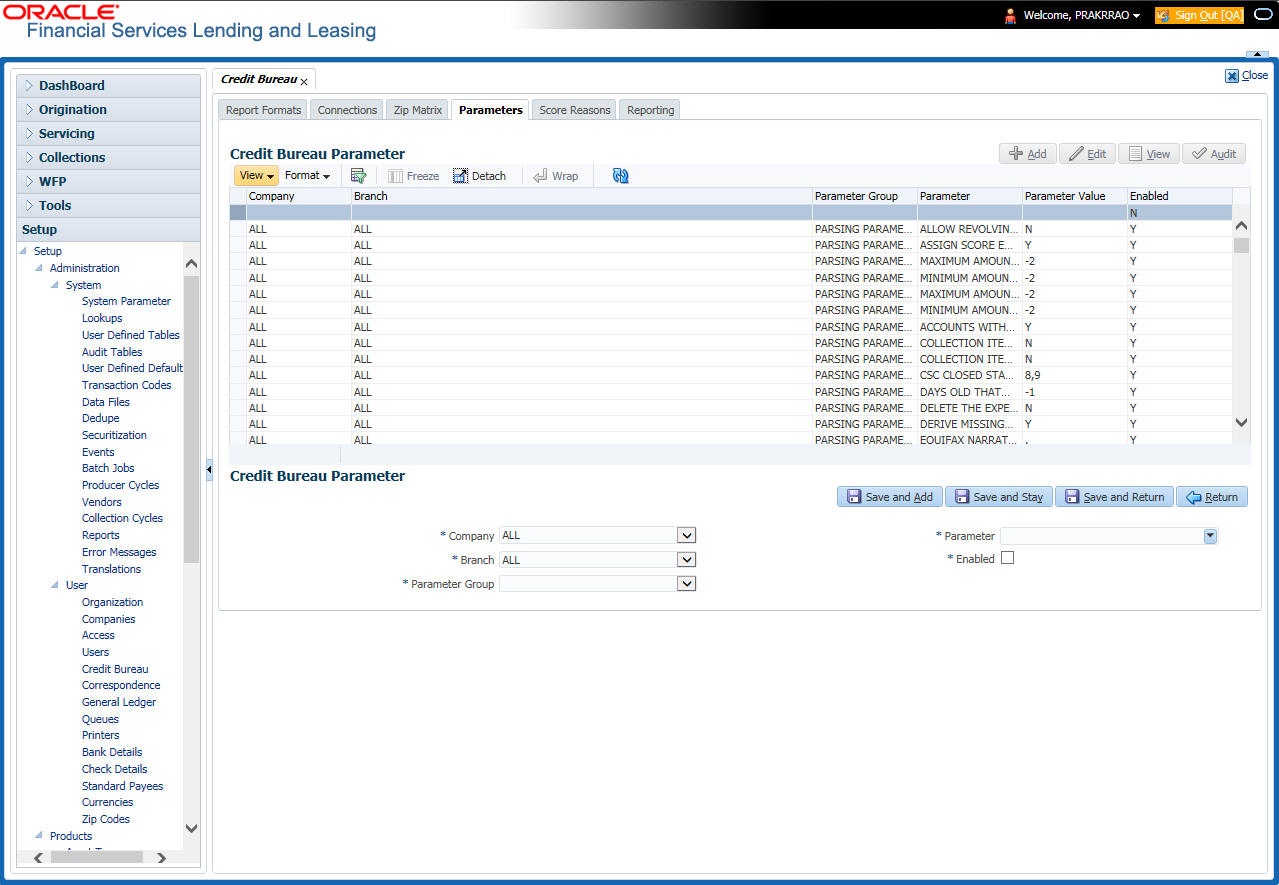

3.5.1.4 Parameters

The Parameters screen records parameters specifically dealing with credit bureau information. These parameters are divided into three groups:

- Parsing parameters

- Request parameters

- Configuration parameters

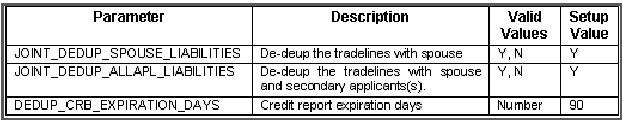

Parameters can be defined at the company or branch level. The following credit bureau parameters are configured during the installation:

PARSING PARAMETERS FOR CREDIT BUREAU SERVICE

CONFIGURATION PARAMETERS FOR CREDIT BUREAU SERVICE

The following credit bureau parameters are configured during implementation:

REQUEST PARAMETERS FOR CREDIT BUREAU Service

Request Parameters for Credit bureau Service

To setup the Parameters

- Click Setup > Setup > Administration > User > Credit Bureau > Parameters.

- In the Credit Bureau Parameters section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Company |

Select the portfolio company from the drop-down list. |

Branch |

Select the portfolio branch from the drop-down list. The branch will be displayed based on the company selected. |

Parameter Group |

Select the credit bureau parameter group from the drop-down list. |

Parameter |

Select the credit bureau parameter from the drop-down list |

Parameter Value |

Specify the credit bureau parameter value. |

Enabled |

Check this box to enable the credit bureau parameter. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

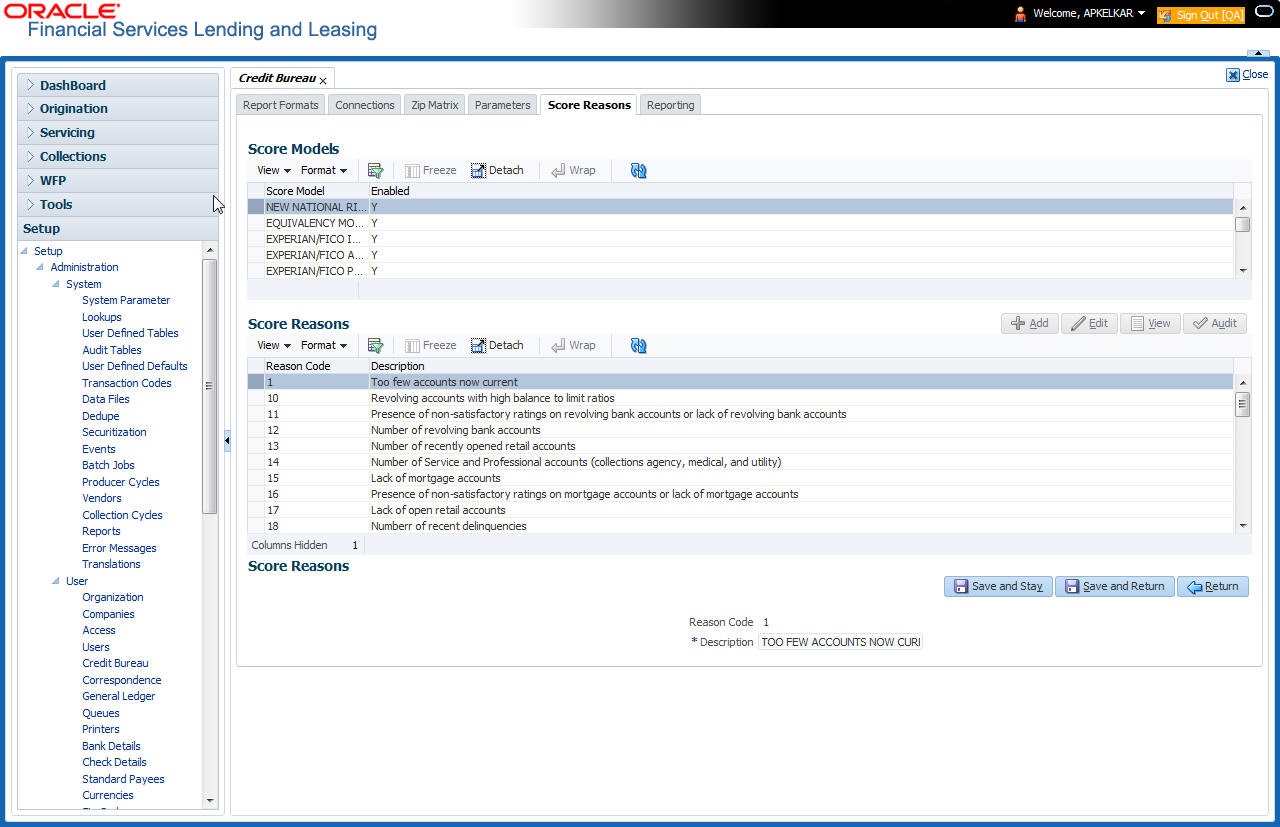

3.5.1.5 Score Reasons

The Score Reasons screen allows you to define or modify the scoring reason codes and descriptions for the predefined scoring models used by the credit bureau agencies.

Note

This information is not associated with the user-defined scores determined by the internal Oracle Financial Services Lending and Leasing model during product setup.

To setup the Score Reasons

- Click Setup > Setup > Administration > User > Credit Bureau > Score Reasons.

- In the Score Models section, you can view the following information.

A brief description of the fields is given below:

Field: |

Do this: |

Score Model |

Displays the credit bureau score model (display only). |

Enabled |

Displays if the credit bureau score model is enabled or not. |

- On the Score Reasons sub screen, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field |

Do this: |

Reason Code |

Specify the reason code. |

Description |

Specify the description. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

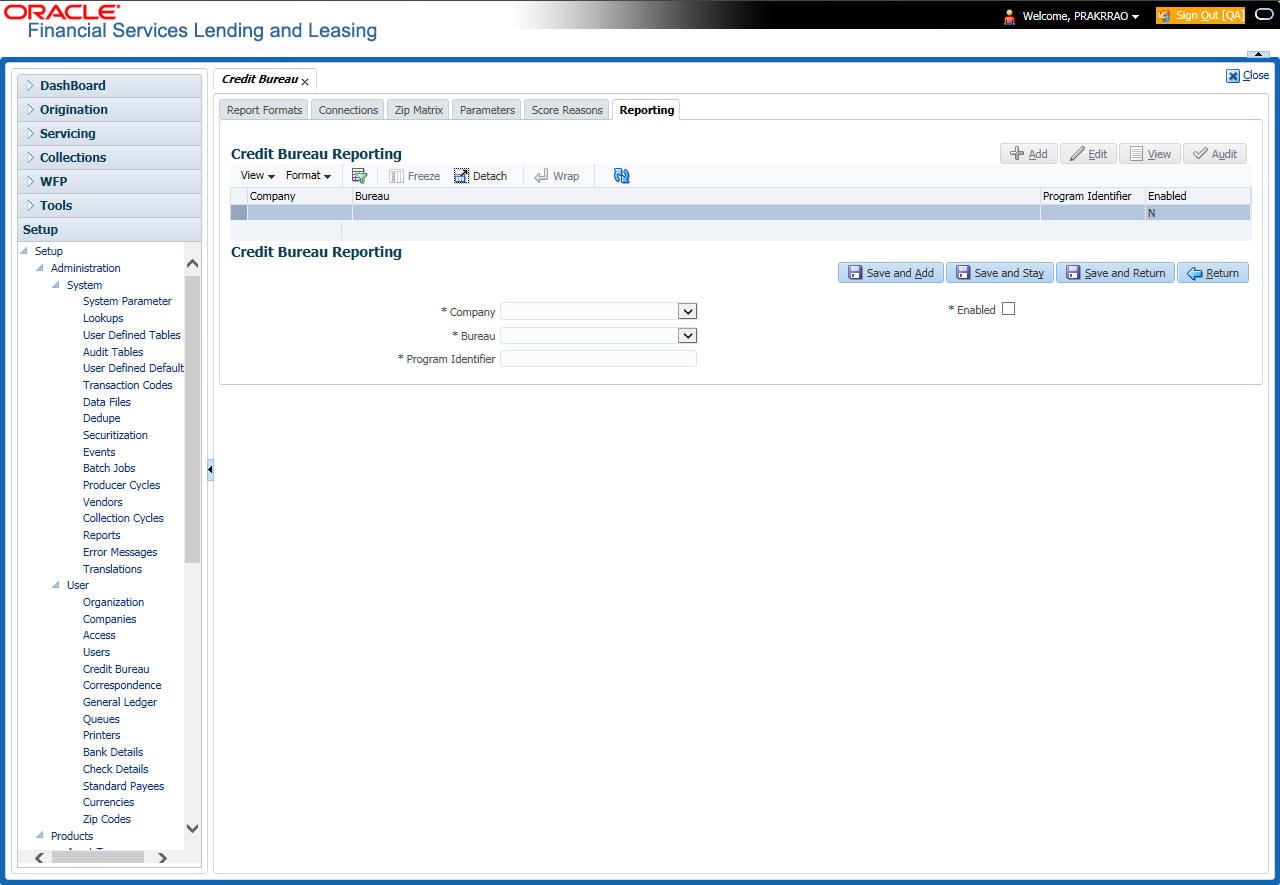

3.5.1.6 Reporting

The system reports to the credit bureau agencies in the Metro 2 format with the payment and account status information of each account holder. The Credit Bureau Reporting screen contains the program identifier to be reported to the bureaus.

To setup the Reporting

- Click Setup > Setup > Administration > User > Credit Bureau > Reporting.

- In the Credit Bureau Reporting section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field |

Do this: |

Company |

Select the portfolio company from the drop-down list. |

Bureau |

Select the bureau from the drop-down list. |

Program Identifier |

Specify the program identifier. The customer receives this from the bureau and uses it to identify itself to that bureau. You will need to update this information. |

Enabled |

Check this box to enable the program. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

3.5.2 Special Metro II Code reporting

The system allows you to report the following special Metro II segments to the credit bureau output file:

- Consumer Information Indicator Code (CIIC)

- Compliance Condition Code (CCCD)

- Special Comment Code (SPCC).

The system users will need to use call Action/Results and Reason fields on the Call Activities sub screen of the Customer Service form (Lending > Customer Service > Customer Service (2) master tab > Account Details tab > Call Activities sub tab) to place specific account conditions where these Metro II segments are to be reported. The specific segment reported for a given condition will be based on the account condition and call activity reason codes.

Note

It is the responsibility of the Administrator or individual user to setup Special Metro II Code reporting functionality.

When users open one of the following conditions:

Code |

Description |

CIIC |

Consumer Information Indicator Code (METRO2 - FCRA) |

CCCD |

Compliance Condition Code (METRO2) |

SPCC |

Special Comment Code (METrO2) |

The system recognizes the condition, processes the selected Metro II reporting call activity reason code, and generates the Metro II reporting segment in the Metro II reporting output file.

Note

- You are responsible for selecting the correct Metro II reporting segment reason code to be reported. If you do not select a Metro II reporting segment reason code, the system will not generate information to Metro II output file. If you select an incorrect Metro II reporting segment reason code, the system will report the selected Metro II reporting segment. the system does not validate the contents of the Reason field with the contents of the Condition field.

- To end the reported Special Metro II Special Code, close the open Special Metro II Condition (no reason code needed). The system recognizes the closing of the open Special Metro II Condition and will not create a Metro II reporting segment in the output file.

- The CBU_FILE_FREQUENCY (METRO 2 FILE FREQUENCY) Company system parameter determines if output file is generated and created daily or output file is written with daily data and output monthly.

To setup Metro II Code reporting

- On the Oracle Financial Services Lending and Leasing home screen, click Setup > Setup > Administration > User > Queues > Call Action Results to open and close the following system defined condition codes:

Action Code

Description

CIIC

Consumer Information Indicator Code (METRO2 - FCRA)

CCCD

Compliance Condition Code (METRO2)

SPCC

Special Comment Code (METRO2)

When setup is completed, you can open and close Special Metro II code conditions.

Note

Opening and closing Special Metro II Code reporting is a manual process.

The CBU_FILE_FREQUENCY (METRO 2 FILE FREQUENCY) Company system parameter determines, if output file is generated and created daily or output file is written with daily data and output monthly.

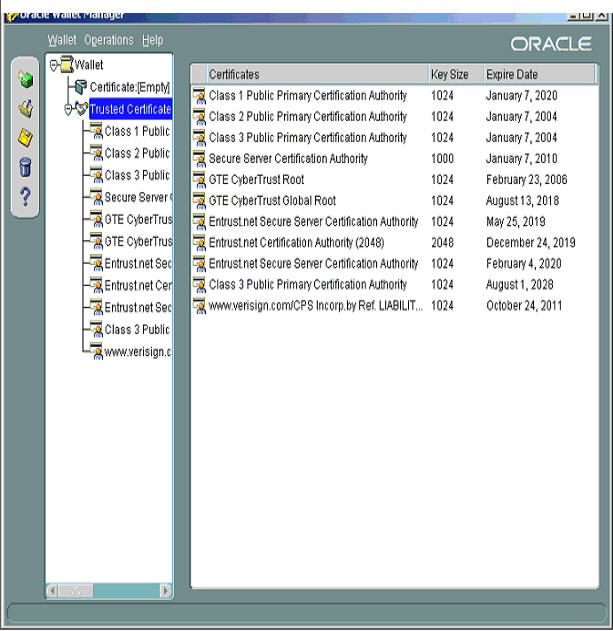

3.5.3 Oracle Wallet Manager setup

The Experian Net Connect, Equifax Internet System to System, and CSC interfaces within the the system credit bureau service use functionality provided by the Oracle Wallet feature. Use the Oracle Wallet Manager on the database server to create and export a wallet for use by the credit bureau service.

Note

All of the above mentioned interfaces use the same Oracle wallet. If a wallet already exists and is in use by one of the credit bureau interfaces, there is no need to create another wallet. Due to differing certificate requirements, there may be a need to import additional trusted certificates into the wallet, but there will not be a need to create a new one. The credit bureau parameter ORA_WALLET_PATH contains the location of the Oracle Wallet used by the credit bureau service.

To create and export a wallet suitable for use by the credit bureau

Refer to the Oracle documentation for more detailed instructions on how to use the Oracle Wallet Manager to create and manage a wallet:

- If a wallet does not already exist, create one somewhere on the database server. The location must be readable and writable by the Oracle user. Make a note of the full path where the wallet is stored (for example, /etc/ORACLE/WALLETS/oracle or C:\oracle\WALLETS).

- For Transunion credit bureau, a separate wallet file is needed under transunion folder inside the main wallet path (for example: /etc/ORACLE/WALLETS/oracle/transunion or C:\oracle\WALLETS\transunion).

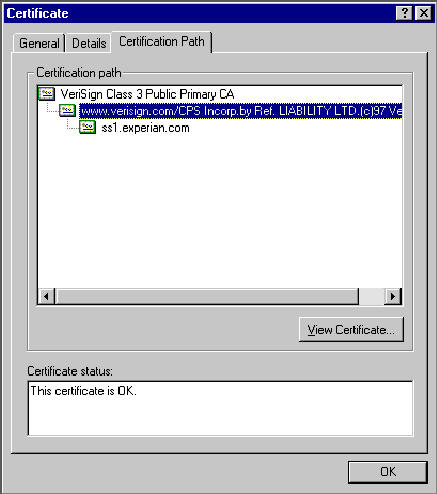

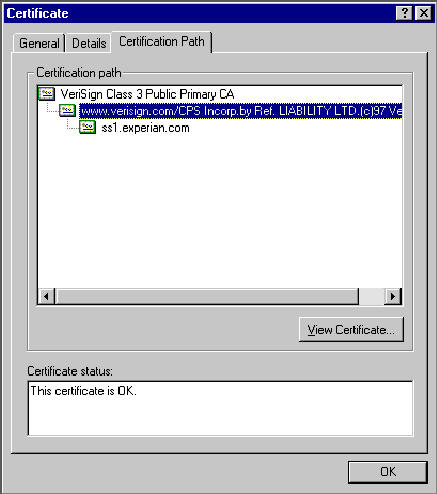

- The wallet needs to contain the public key for the certificate authority that issued the server certificate for each HTTPS web site that will be connected to by the credit bureau interface. At the time of this document, those sites are:

https://ss1.experian.com

Experian

https://transport5.ec.equifax.com

Equifax

https://www.emortgage.Equifax.com

CSC

This list may change. Use the URL provided to you by the credit bureau when they set up your service. To get the proper Experian HTTPS URL, enter the ECALS URL that was provided by Experian into a web browser. The response returned to the browser is the HTTPS URL that will be used to communicate with Experian.

- Import the necessary certificate authority’s certificate files into the Oracle wallet that was created in Step 1. See the appendix of this chapter for detailed instructions of how to download and install a trusted certificate.

- Test the wallet by connecting to each web site with a simple command issued from SQLPlus.

SQL> select utl_http.request('https://ss1.experian.com', NULL, 'file:/etc/ORACLE/WALLETS/oracle', 'password') from dual;

Replace the URL in the above command with each HTTPS URL given to you for use by the credit bureaus. Also replace the wallet path with the path to your wallet and your wallet password. The output from the command is not important, what is important is that it runs without displaying an Oracle error. If there is an Oracle error, then something is wrong with the contents of the wallet, the path to the wallet, and/or the wallet password.

- When the wallet contains all of the required trusted certificates, export the wallet to a text file. On the Operations menu of the Oracle Wallet Manager, choose Export All Trusted Certificates. The text file MUST be located in the same directory as the wallet and the filename MUST be default.txt. Anytime a change is made to the trusted certificates in the wallet, the wallet must be re-exported to the same text file.

- In the Setup > Setup > Credit Bureau > Parameters set the ORA_WALLET_PATH and ORA_WALLET_PASSWORD parameters.

3.5.4 Oracle JVM Security setup

The Experian Net Connect interface within the credit bureau service requires the use of the Oracle Java Virtual Machine (JVM) that is resident in the Oracle database. Furthermore, specific permissions must be granted to the Java classes used by the credit bureau service. These permissions have been added to the set_java_perms.sql script that is part of the distribution. This script (as well as many other useful SQL scripts) is available from the Oracle Financial Services Software technical support Oracle Financial Services Lending and Leasing patches web site.

The set_java_perms.sql script needs to run as the SYS user (or a user with SYS privileges). The script will prompt for SYS user id and password. Be prepared to provide it when prompted. Also, the script will select the value of the ORA_WALLET_PATH parameter from the credit bureau parameters table. Make sure that it has been updated with the proper wallet path before running the set_java_perms.sql script (although the script can be safely run again if necessary).

Credit Bureau Service operation

The basic operation of the credit bureau service has not changed. Once setup, there is no operational difference between accessing the credit bureaus via dial-up, frame relay, or the Internet.

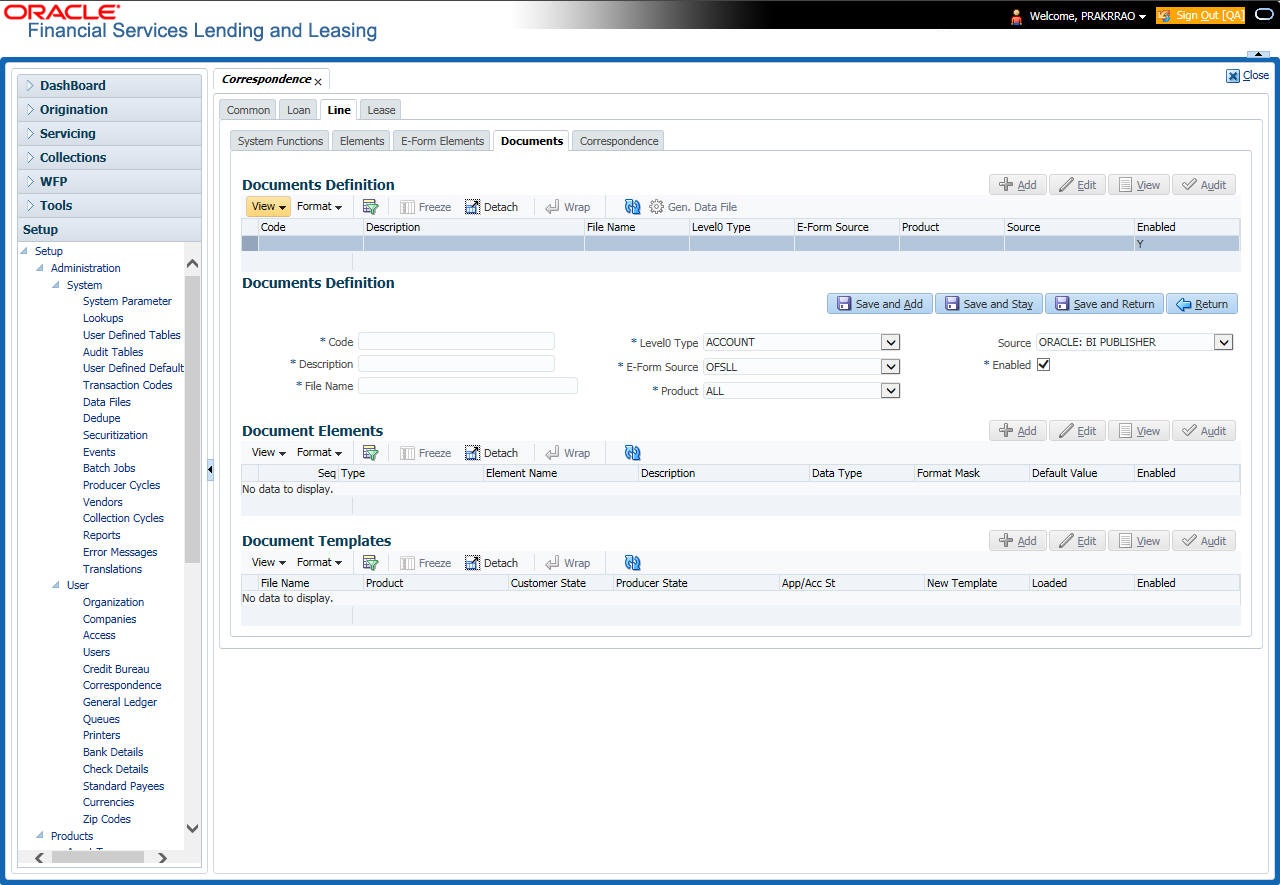

3.5.5 Importing a trusted certificate into an Oracle Wallet